Labour negotiations are set to kick off between the Detroit Three auto makers and the union representing Canadian auto workers Wednesday at a key moment for the industry in this country.

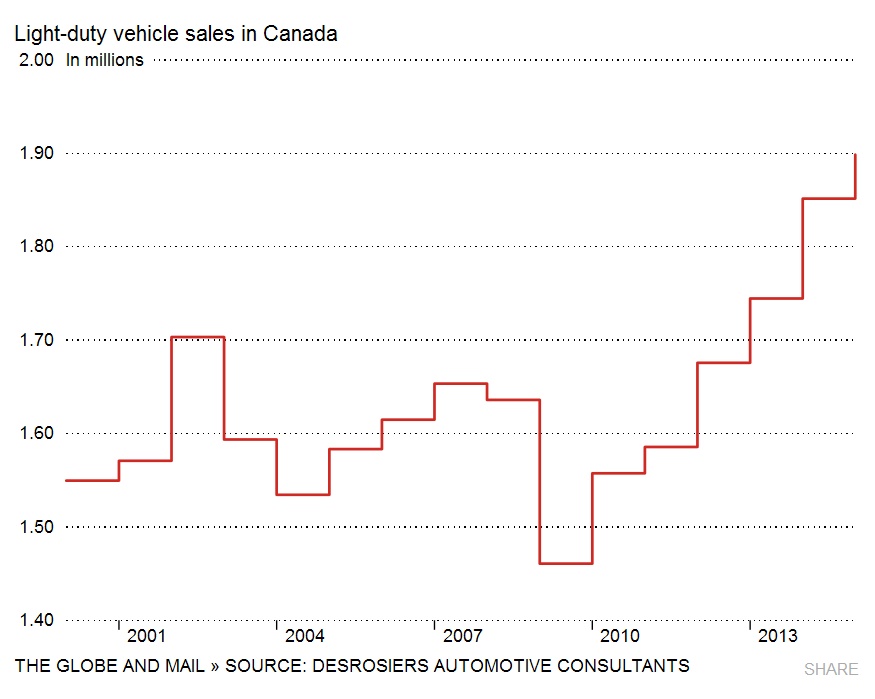

During the last major round of bargaining with the Detroit Three in 2009, the parties’ focus was on re-establishing a solid footing in the wake of the 2008 financial crisis. Now, plants in Canada are facing questions about whether they will have products to build in the years to come.

“We’re at a crossroads in the auto industry in Canada,” Jerry Dias, president of Unifor, said in a phone interview Tuesday. “We’ve got enormous challenges ahead of us in the next couple months.”

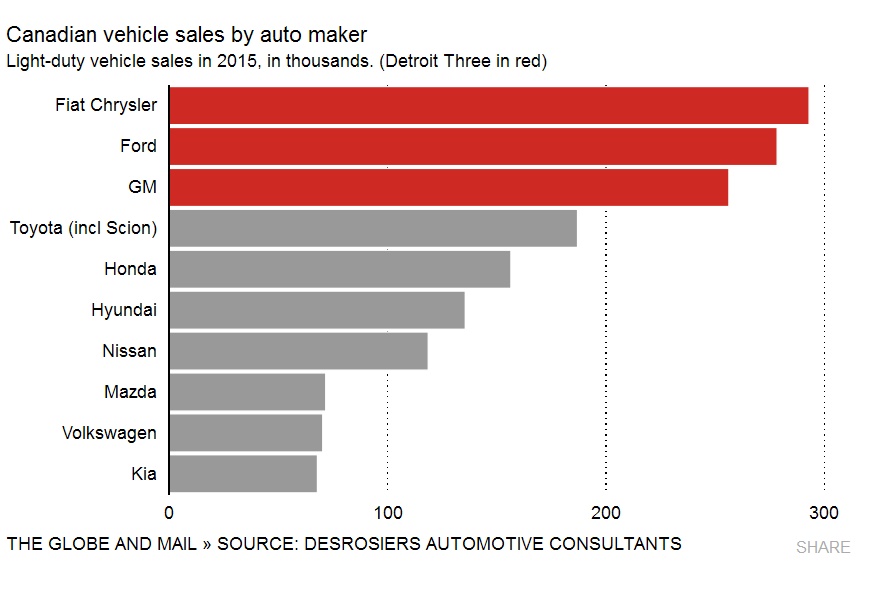

The focus of the negotiations revolves around contracts at GM’s assembly plant in Oshawa, Ont., Ford’s engine factories in Windsor, Ont., and Chrysler’s assembly plant in Brampton, Ont. Existing contracts with the three auto makers expire on Sept. 19.

One of the key issues will be ensuring that GM allocates new vehicles to the Oshawa plant, which currently plans to end one of its two production lines next year, cutting 1,000 jobs with it. It doesn’t have any new vehicles scheduled for production after 2019, with the Chevrolet Equinox compact crossovers and the Buick Regal expected to leave Oshawa in 2017.

Unifor, Canada’s largest union in the private sector, represents about 23,000 workers at the Detroit Three auto makers in Canada. Talks begin with General Motors of Canada Ltd. on Wednesday, followed by Ford Motor Co. of Canada Ltd. and Fiat Chrysler Canada on Thursday. Bargaining is expected to continue with the auto makers till the end of August, and a pattern-bargaining target is expected to be chosen by Sept. 5. (Editorial, advertising and circulation employees of The Globe and Mail are also members of Unifor.)

Pattern bargaining is a collective-bargaining technique in which the union uses the precedent of one contract agreement as a model for others during labour negotiations. Unions focus on one company, establishing the pattern that will serve as a template for contracts with the other auto makers. Once a deal is reached with the first company, the focus will switch to the second company and then the last of the three. Unions choose the pattern target based on the criteria that they have prioritized.

“It’s crystal clear that the priority is product,” Mr. Dias said. In the face of a shift of more work to the southern United States, where government investment is strong, and Mexico, where labour costs are lower, the need to secure new products for Canada is crucial. In the past decade, Mr. Dias said, Mexico has opened eight assembly plants, while Canada has closed two. Despite a low Canadian dollar and strong North American auto sales, future contracts are at risk. Now, he’s looking to avoid further plant closings and the corresponding job losses.

While the auto makers have declined to comment until the negotiations begin, Stephen Carlisle, president of General Motors Canada Ltd., has said repeatedly in the past that no decisions will be made on allocating new vehicles to the Oshawa plant to replace cars that are going out of production or shifted elsewhere until after the negotiations with Unifor.

Mr. Dias said there’s a lot to lose. The focus needs to be on solidifying products and business for each facility, he said.

“If we don’t negotiate a product and stabilize the [GM] facilities during this set of negotiations, it will close,” he says.

The case is similar for the Ford engine plant in Windsor, which lost out on a contract to a plant in Mexico last year. And then there’s the Fiat Chrysler plant in Brampton, where Mr. Dias says the focus is on upgrading the paint shop.

This set of negotiations is arguably more important than the 2008-2009 restructuring of the auto industry during the financial crisis, when the negotiations followed government bailouts of GM and Chrysler.

“We knew coming out of the restructuring agreement that the jobs were still going to be there. We just had to make sure with the companies and the governments that everything ended on stable footing,” Mr. Dias said.

But this time around, those restrictions aren’t there. “The commitments that Chrysler and GM made to the provincial and federal governments have expired. So now, for them, it’s business as usual without any commitments,” he said.

“This is a big deal. This is really going to be about the manufacturing sector in the long term in Canada. So there is everything at stake in this set of negotiations.”

KIRAN RANA

The Globe and Mail

Published Tuesday, Aug. 09, 2016 10:15AM EDT

Last updated Wednesday, Aug. 10, 2016 6:02AM EDT