Cars are overtaking houses as the definitive symbol of our preference for spending over saving.

We had both houses and cars going strong for a while there, kind of like a Batman and Robin superhero team of consumer spending. But while the housing market is slowing in many places outside of Vancouver, Calgary and Toronto, cars are still flying.

“Auto credit has increased considerably and is moving ahead at a double-digit rate,” said BMO Nesbitt Burns Inc. economist Alex Koustas.

Americans are buying cars like crazy, and we Canadians are more than holding up our end of this critically important sector of the economy. Rarely have so many consumers made seemingly rational buying decisions with such negative long-term consequences.

To be honest, now’s an outstandingly good time to buy a vehicle. Mr. Koustas, author of a quarterly review of the North American auto industry, said low interest rate financing is widely available, even on some premium brands. Also, cars have never been better.

“You can replace a 10-year-old car with a new one with twice as many features and much better gas mileage,” Mr. Koutsas said. “Cars are a much more attractive product than they used to be.”

Houses are increasingly unaffordable because prices have risen well in excess of incomes in recent years. But a basic car might cost you pretty much the same as it did a decade or so ago as a result of a rise in the Canadian dollar and Asian car makers introducing competitive low-cost vehicles into the Canadian market.

There’s more to the car-buying trend than consumers responding to perfect market conditions, however. As Mr. Koustas reads the numbers, people are allocating more of their spending to cars than ever before.

Americans have roughly 0.9 cars for every person of driving age. Here in Canada, we’ve gone from 0.6 to 0.7 over the past several years. “It appears there’s a bit of a shifting of preferences out there,” he said. “People are reaching out to get that extra car – the convertible, the Jeep or something.”

Car loans accounted for about 7 per cent of non-mortgage consumer debt a decade ago, Mr. Koustas added. That share rose to 14.7 per cent at the end of last year, and then dipped to 12 per cent early this year. Sales have heated up since then, so cars can be expected to reclaim a higher share of our debt loads.

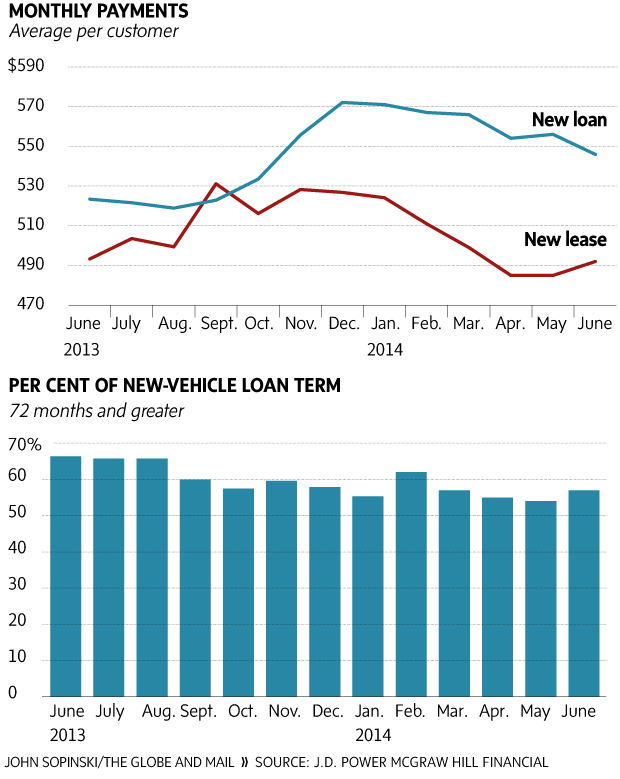

Our car-buying spree looks like smart consumption only until you consider the details on how we’re paying for our new vehicles. Data from the analysis firm J.D. Power shows that 78 per cent of new vehicles are acquired with loans or on lease. The average new loan payment is in the $550 range, while the average lease payment is roughly $490. Those are big numbers.

Worse still is the fact that 57 per cent of new-vehicle loans are being stretched out for 72 months or longer. This helps explains why close to 30 per cent of vehicles being traded in on the purchase of a new car or truck are worth less than the amount outstanding on the loans used to buy them (this is called negative equity).

The long-term consequence of today’s car-buying splurge is that people are locking themselves into a cycle of consumption that suffocates saving. This is how we roll here in Canada. House sales were up 11.2 per cent in June over the same month of 2013, in large part thanks to the Calgary, Vancouver and Toronto markets; car sales last month were up 2 per cent from a year earlier, enough to put us on track to break last year’s record sales level. Savings? Statistics Canada’s report on the household savings rate in early 2014 showed a decline, albeit a small one, from the year-earlier period to 4.9 per cent.

If you wonder why people in the pension business and some governments are worried about Canadians not saving enough for retirement, start here. We are wired to spend, not to save. Consumption comes first.

That’s why we need to make saving for retirement non-discretionary, like it is in the Canada Pension Plan and the proposed new Ontario Retirement Pension Plan. Deduct the money from paycheques and require people to take concrete action to opt out, like filling out detailed forms in triplicate.

Gradually over the past decade or so, Canadians got used to carrying huge levels of debt. They’ll get used to saving, too.

This data from J.D. Power offer some perspective on the debts that people are taking on for vehicles.

ROB CARRICK

The Globe and Mail

Published Monday, Jul. 28 2014, 4:49 PM EDT

Last updated Monday, Jul. 28 2014, 6:54 PM EDT