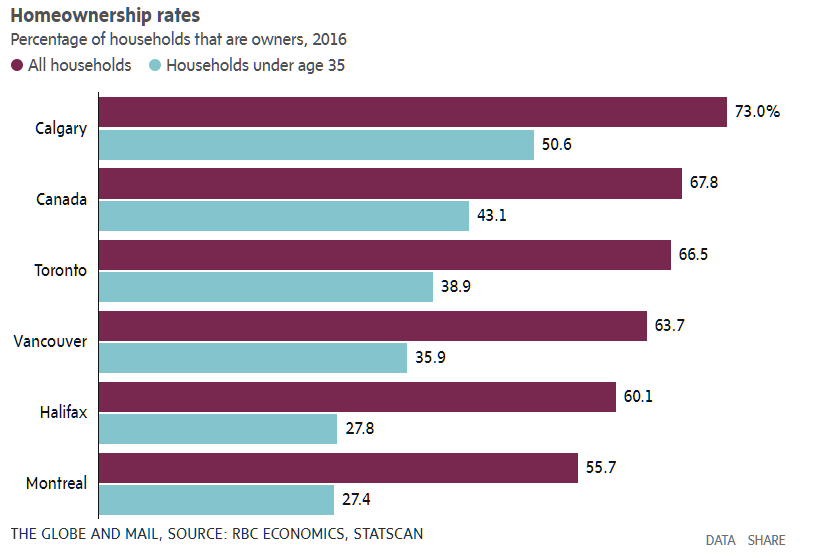

The budget included a raft of measures aimed at improving home affordability. One notable inclusion is the First-Time Home Buyer Incentive, which would allow buyers to share the cost of purchasing a home with the Canada Mortgage and Housing Corp.

Under the plan, eligible first-time home buyers could finance part of their purchase through a shared-equity mortgage with CMHC. The incentive is for insured buyers – those who make a down payment of less than 20 per cent. It would reduce a buyer’s total borrowing costs and therefore their monthly mortgage payments.

The incentive is subject to various conditions, including that buyers have a household income below $120,000 a year. Full details of the incentive are forthcoming.

CMHC would offer eligible buyers a 10-per-cent shared-equity mortgage for newly constructed homes or 5 per cent for existing homes. The housing agency would provide up to $1.25-billion over three years, and the plan is expected to go into effect this September.

The budget offered an example of how the incentive would work. For a $400,000 home purchase, an insured buyer must have 5 per cent (or $20,000) for the down payment. For a new home, a shared-equity mortgage would offer $40,000, lowering the total borrowing costs to $340,000 from $380,000. The incentive would be repaid when the home is sold.

Separately, the government announced changes to how registered retirement savings plans can be tapped for home purchases. The Home Buyers’ Plan allows first-time buyers to withdraw money from their RRSPs to purchase a home without having to pay tax on the withdrawal. The withdrawal limit is increased to $35,000 from $25,000, effective immediately.

Pharmacare

As part of last year’s budget, Ottawa announced it was forming an advisory council, chaired by former Ontario health minister Eric Hoskins, to explore the creation of a national prescription-drug program. While the council’s final report and recommendations aren’t due until the summer, the 2019 budget lays out a road map for how pharmacare will be rolled out.

The government is proposing to create a new department, the Canadian Drug Agency, to manage federal pharmacare. The agency will be responsible for establishing what will ultimately become a national formulary, listing which drugs are covered under the program. To establish this office, the government is earmarking $35-million for Health Canada over four years.

The budget also included funding for the development of a national strategy for high-cost drugs for rare diseases. In some cases, these drugs can cost upwards of $100,000 a year per patient. The government is promising $1-billion in funding over two years, starting with the 2022-23 fiscal year, plus up to $500-million each year after that.

Skills training

The budget included several measures to help Canadians boost their job skills.

The Canada Training Credit is intended to help workers between 25 and 64 pay for training costs. Every year, eligible workers would accumulate $250 in training credits, rising to a lifetime total of $5,000. Canadians could apply their accumulated credit against half their training fees and claim their refund when filing tax returns.

The budget also proposes support through the Employment Insurance program. Under the benefit, eligible workers could receive up to four weeks of income support – paid at 55 per cent of average weekly earnings – every four years while on training and without regular pay.

Both the training credit and EI benefit are expected to launch in 2020.

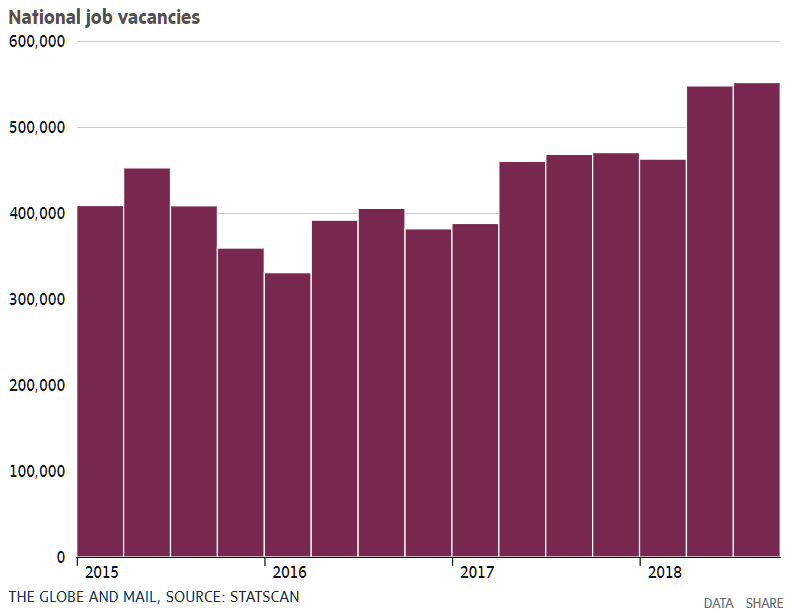

National job vacancies have risen sharply over the past couple of years, according to Statistics Canada data, with many employers saying they struggle to hire people with the right skills.

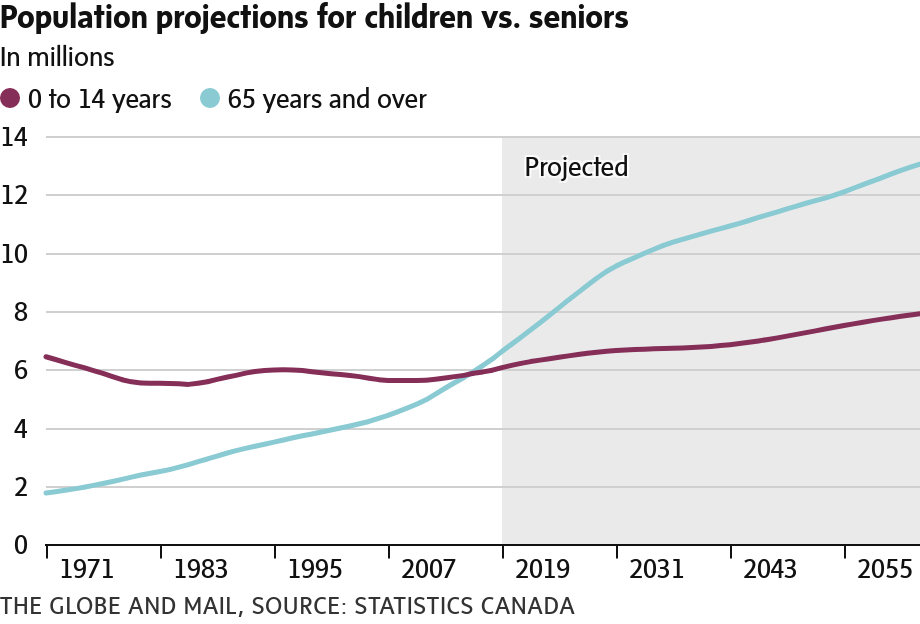

As expected, the budget included a series of measures aimed at improving the lives and security of seniors and those nearing retirement.

According to the government, approximately 40,000 people 70 or older are currently not enrolled in the Canada Pension Plan, meaning they aren’t receiving a monthly retirement pension (the budget calculates that this would be $302 a month on average in 2020). The budget is proposing to pro-actively enroll eligible seniors so they don’t miss out on their CPP benefits.

The budget also included measures aimed at increasing transparency during insolvency proceedings, giving courts the ability to review executive compensation during insolvencies, and protecting pensions when a company goes under, as was the case with Sears Canada in 2017.

The government is also proposing an increase to the guaranteed income supplement (GIS) earnings exemption for low-income seniors, from $3,500 to $5,000. In practice, this means seniors receiving the GIS will be able to exempt $1,500 more in income each year before claw-backs.

The budget also included $50-million over five years to the Public Health Agency of Canada for the development of a National Dementia Strategy, slated to be unveiled this spring.

Indigenous programs

The budget promised billions of dollars for Indigenous communities and continuing reconciliation efforts. One of four major budget initiatives, the “Advancing Reconciliation” section alone totalled $4.7-billion in new measures, or 21 per cent of new spending.

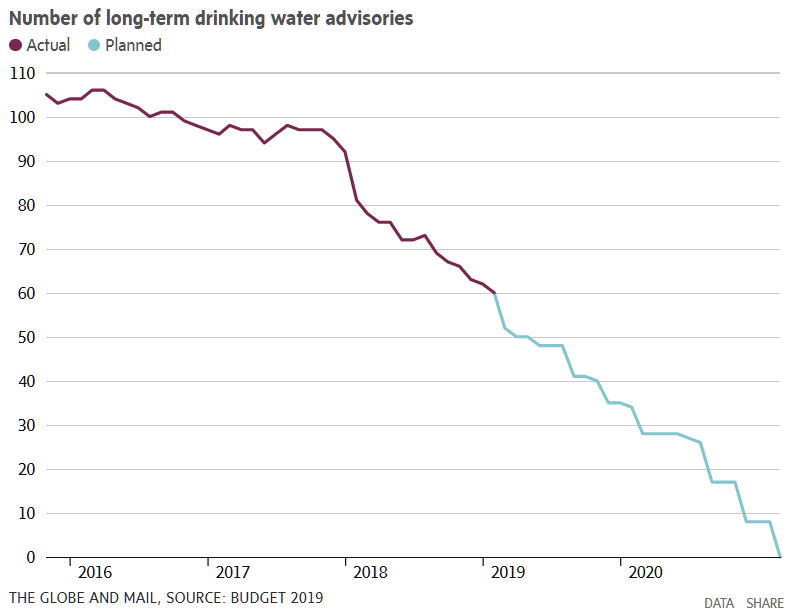

The measures include funding to support ongoing claims settlements, investments in governance for First Nations, money to permanently fund surveys on Indigenous people and the health of First Nations communities and more. One measure proposes $1.2-billion over three years for First Nations children’s access to social, educational and health services; another earmarks $220-million over five years for Inuit children. Nearly $740-million has been set aside over the next five years for the elimination of drinking water advisories in First Nations communities.

The government is also proposing to invest $333.7-million over five years to implement the already-proposed Indigenous Languages Act, with $115.7-million committed every year after that.

Funds were also proposed to specifically address several of the Truth and Reconciliation Commission’s calls to action, including $126.5-million in fiscal 2020-21 for the establishment of a National Council for Reconciliation.

The budget’s proposals would also finalize the restructuring of federal Indigenous agencies into two departments, a split announced in 2017: Indigenous Services Canada, which was set up last year, and Crown-Indigenous Relations and Northern Affairs Canada.

Electric vehicles

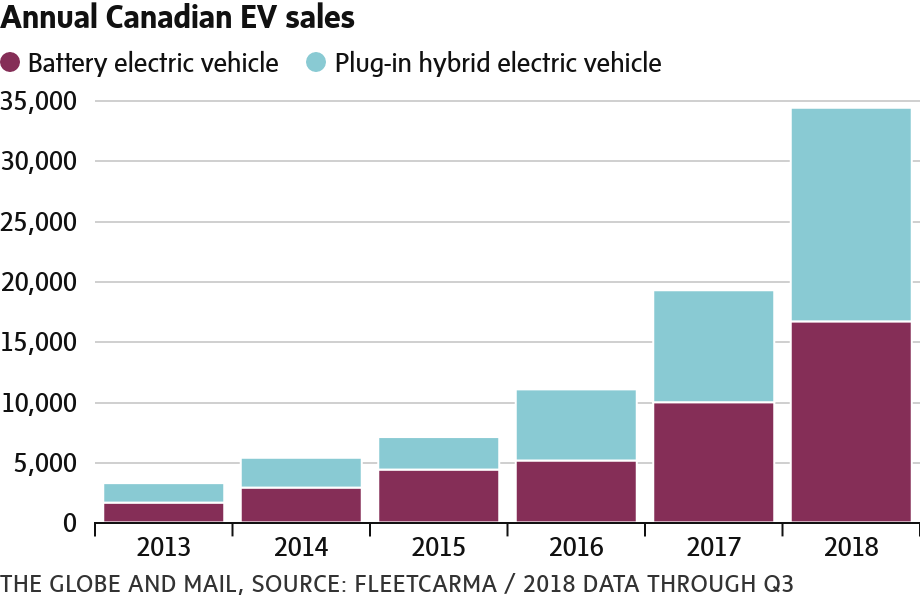

The government is looking to stoke the adoption of zero-emission vehicles – but not only for consumers.

To help businesses buy such vehicles, the budget proposed making them eligible for a full tax writeoff in the year they’re put in use. Applicable vehicles would include electric-battery, plug-in hybrid or hydrogen-fuel-cell vehicles. Capital costs for eligible passenger vehicles would be deductible up to a limit of $55,000 plus sales tax.

On the consumer side, the budget included a new federal incentive of up to $5,000 for purchases of electric-battery or hydrogen-fuel-cell vehicles with a manufacturer’s suggested retail price of less than $45,000. Ontario’s now-defunct incentive was criticized because, in its first iteration, it could be used for purchases of six-figure vehicles.

Canadian sales of zero-emission vehicles are on the rise but remain a small portion of the overall market.

Supply management

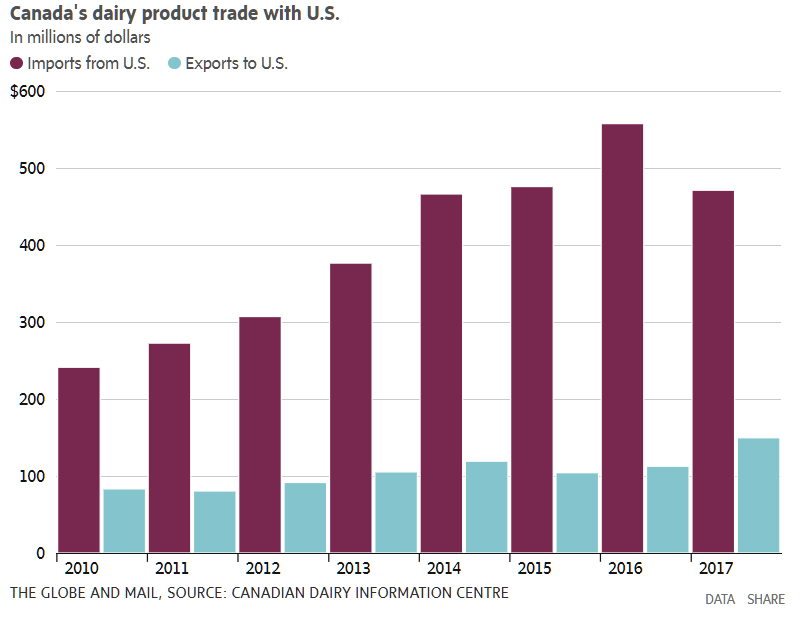

The government has earmarked billions in support for supply-managed farmers.

This follows an uproar from dairy farmers, in particular, after Canada ceded some of the domestic market to U.S. producers in the new North American trade pact, which has yet to be ratified. After the deal goes into effect, roughly 10 per cent of the domestic dairy market will be open to outside producers.

The budget proposed up to $3.9-billion in support for the supply-managed group. This included up to $2.4-billion to “sustain the incomes” of eligible dairy, poultry and egg farmers, of which $250-million has already been provided after the European trade pact. It also included $1.5-billion to protect against the drop of quota values when quota is sold.

High-speed internet

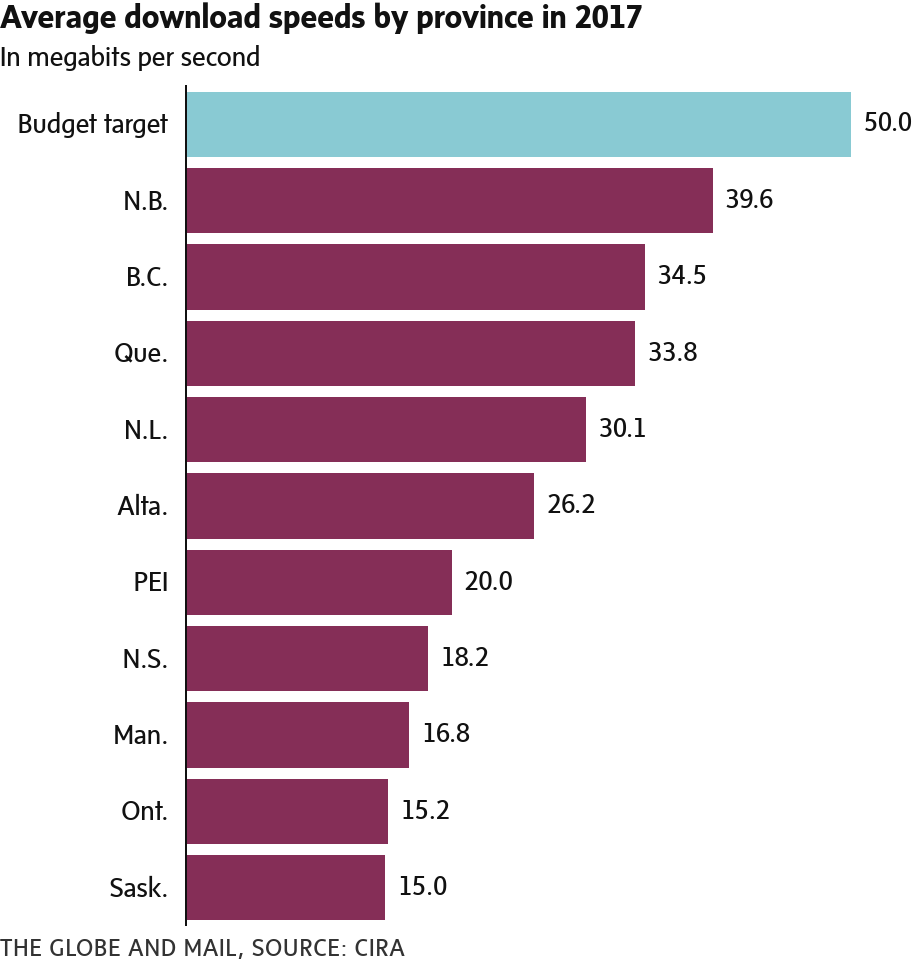

While past budgets have included funds to build out Canada’s high-speed internet infrastructure, this year the government set a national access target. By 2026, Ottawa aims to have 95 per cent of Canadian homes and businesses with access to minimum download speeds of 50 megabits a second and upload speeds of 10 megabits a second. By 2030, the government is targeting 100-per-cent coverage at those speeds.

To accomplish this, the budget proposed the creation of the Universal Broadband Fund, which would receive up to $1.7-billion over 13 years, starting in the 2019-20 fiscal year, with $717-million of those funds being spent in the next five years. The fund would focus on building out critical high-speed internet infrastructure in underserved communities and would include money for a low Earth orbit satellite program, to be launched this spring.

The budget also promised $11.5-million to Statistics Canada over five years for the development of two surveys on measuring household internet access and use and business adoption of digital technologies. The last published surveys of this sort were conducted in 2012 and 2013, and the results of a 2018 survey on household internet use are slated to be published in the fall.

Journalism

This year’s budget included the first concrete details on the federal government’s strategy to support journalism.

Under the government’s proposed system, journalism outfits can apply for “Qualified Canadian Journalism Organization” (QCJO) status, making them eligible for credits and other benefits. To become a QCJO, an organization would need to operate and be incorporated in Canada and chaired by a Canadian; at least 75 per cent of its directors must be Canadian; and it must be at least 75-per-cent owned by Canadians. These and other criteria for QCJO status would be managed by an independent panel, and an administrative body will be created to handle status designation.

Starting Jan. 1, 2020, QCJOs would be able to register with the Canada Revenue Agency for “qualified donee status,” meaning they can accept donations and issue tax receipts like registered charities.

QCJOs would also qualify for a 25-per-cent labour-tax credit on salaries paid to newsroom employees (capped at $13,750 in tax credits per employee each year). Certain broadcast outlets and organizations receiving funding from the Canada Periodical Fund won’t qualify for the labour-tax credit.

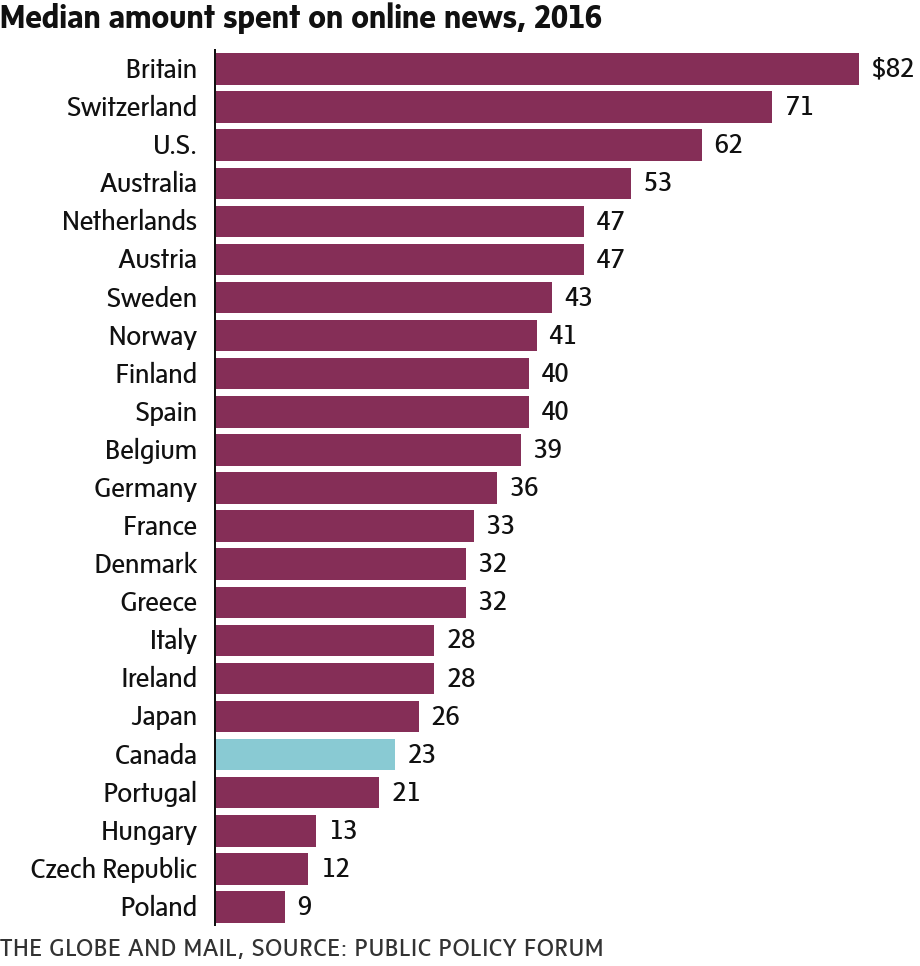

Finally, the budget also proposes a temporary personal tax credit on digital news subscriptions from QCJOs. Individuals will be able to claim a 15-per-cent credit on subscriptions totalling $500, for a $75 maximum annual tax credit.

Miscellaneous

- The government proposed to introduce legislation that would allow the Canadian Air Transport Security Authority to transition into an independent, non-profit entity.

- Following the Phoenix pay issues, the government proposed more than $540-million in additional spending to stabilize the current pay system and ensure it has adequate resources.

- The budget proposed $89-million in new funding for the Public Prosecution Service of Canada. The public prosecutor’s office is involved in negotiating remediation agreements; SNC-Lavalin Inc. pursued such an agreement over its Libya-related charges.

- The government plans to introduce new requirements for federally regulated financial institutions to disclose policies for promoting gender diversity at the board level and in senior management. Federally regulated banks include Canada’s Big Six.

- The government pledged millions for anti-money laundering efforts, including the creation of a dedicated team as a pilot initiative.

- Following the cancellation of Greyhound bus services in Western Canada, $15-million is proposed to support affected communities “where no other service provider has emerged.”