If a bond-rating agency took a look at our household finances, a lot of us would get the Ontario treatment.

Moody’s Investors Service changed its outlook to negative last week on Ontario’s credit rating. The rationale: Higher-than-expected deficits are projected for the next two years, along with weak growth. The same could be said of finances in a lot of households across the country.

Why be polite about it? Household finances in this country have a negative outlook, just like Ontario. Governments are not the only ones who are bad with money.

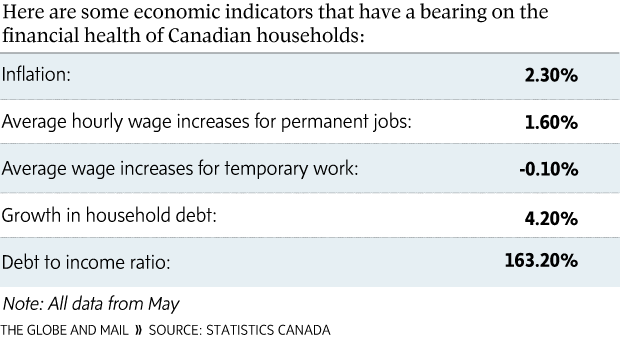

Canadians on average owe $1.63 for every dollar of after-tax income – there’s our deficit. Weak growth applies to our wages, which as of the latest reading were increasing at average levels that are below the 2.3-per-cent rate of inflation recorded in May. Meanwhile, the amount of money borrowed through mortgage, loans, lines of credit and such has been growing steadily at a rate of 4.2 per cent.

Bond raters dig deeper than numbers such as these when evaluating how much confidence investors can have that governments and corporations will pay what they owe on the bonds they issue to finance their operations. So let’s do likewise on your finances, especially the employment issue.

In a way, employment parallels the importance of the economy for governments such as Ontario. At 7 per cent, the national unemployment rate in May was reasonably low by historical standards. Given how soft the economy has been, that’s significant.

Still, there are reasons to wonder how confident Canadians should be that their jobs and incomes will sustain their growing debts. Behind the headline numbers for jobs is a disquieting trend of full-time jobs disappearing while part-time work grows.

A TD Economics report says part-time jobs increased by 112,000 in the 12 months to May 31, while full-time employment fell by 26,700 jobs. TD said 62,000 of the new part-time jobs were filled by people choosing to work part-time for personal reasons, while 50,000 or so were forced into it by economic conditions.

Temporary employment, or working on contract, has also risen as a share of the work force. In May, temporary workers saw their average hourly pay fall 0.1 per cent on a year-over-year basis. That compares with an average 1.6-per-cent gain for permanent workers and an overall rate of 1.4 per cent.

Moody’s has so far pronounced only on Ontario’s outlook, which fell to negative from stable. The province’s actual credit rating could be downgraded if it doesn’t take credible steps to get spending back in line with revenues.

The big difference between Ontario and you is that governments can raise taxes, if needed, to get their finances straightened out. Individuals have no 100-per-cent guaranteed way of raising more money if required. In fact, there is only one way to get your finances in order: Contain your spending.

Is this happening already? Although there are still real estate hot spots, demand for mortgages has eased a bit in recent months. But data from May suggest that other types of borrowing, such as lines of credit and loans, are on the rise. That’s the kind of trend that prompts a bond rater to cut its rating, not just its outlook.

Governments and corporations are seriously affected when their credit rating is cut because they must pay higher rates on the bonds they issue. But individuals can get away with a lot. No one reassesses your finances when you renew a mortgage, when you draw down on a line of credit arranged years ago or suddenly start carrying a credit card balance.

Your credit rating won’t be downgraded because your finances are a mess, but your life might be. Your retirement might be affected, or your ability to help out your kids or aging parents. If interest rates rise, your standard of living in the here-and-now may drop as you pay more to service your debt.

I said in a column a few months ago that I wasn’t going to nag people about high debt loads and the risk of rising interest rates. Rational argument is better for an adult conversation. Accordingly, let’s be careful about mocking Ontario for the fiscal management that led to the outlook downgrade. There are plenty of households in this country that are just as bad or worse.

Rob Carrick

The Globe and Mail

Published Monday, Jul. 07 2014, 5:30 PM EDT

Last updated Monday, Jul. 07 2014, 7:27 PM EDT