As Canadian television moves to an unbundled world over the next two years, experts say cable companies will face some revenue pressures but broadcasters will be hit harder.

The Canadian Radio-television and Telecommunications Commission issued its long-awaited “pick-and-pay” ruling Thursday, confirming that by the end of 2016, television distributors will have to offer a basic package capped at $25 and give customers the ability to add individual channels or small bundles on top of that.

Analysts expect customers will take advantage of the new options and create personally tailored television packages to watch in addition to online programming services like Netflix, whose viewership is growing rapidly.

“This is essentially the government or the CRTC encouraging the industry to move towards an online distribution model,” said Greg MacDonald, head of research at Macquarie Capital Markets Canada. “What happens when that’s the case is that companies lose pricing power and the potential for subscriber risk also increases, because it increases the options customers have.”

Desjardins Securities’ Maher Yaghi suggested customers would gravitate toward the pick-and-pay model. “You’re going to have so many more options to get TV online that you don’t need to have your TV stocked up with all the channels,” Mr. Yaghi.

He added that television distributors will likely increase the amount they charge for Internet services to help make up for this migration.

“In an Internet-centric mode of viewing TV and having access to TV through online, the companies will probably compensate any pressure on their … ARPU [average revenue per user], with Internet fees,” he said.

Ironically, Mr. Yaghi predicted that the CRTC might have to hold another hearing two to three years from now to consider high Internet prices.

Earlier this week, he predicted that the mandated increase in customer choice would lead to a $5 to $10 decrease in the ARPU television distributors take in per month. Television ARPU was $63.66 per subscriber in 2013, according to the CRTC’s most recent figures.

Ken Engelhart, vice-president of regulatory affairs at Rogers Communications Inc., admitted that “there will be some revenue coming out of the system, yes,” but added that he did not think it would be dramatic.

“A lot of millennials are cutting the cord anyway. So offering them a small basic and then à la carte may be less revenue than people are paying today, but it’s better than them cutting the cord altogether,” he said.

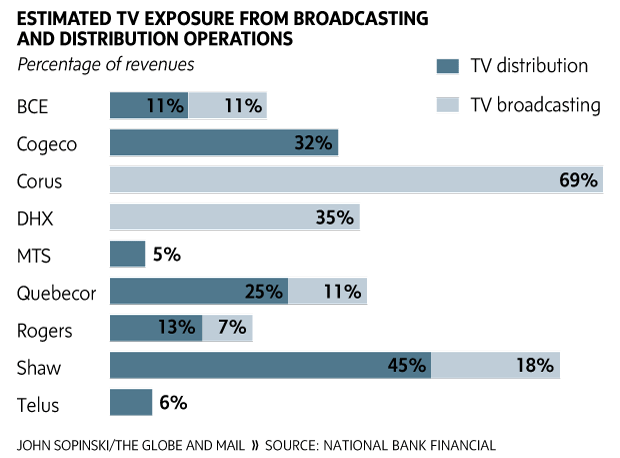

While Rogers also has a broadcast business, its television distribution division accounts for more of its revenue, which also gives it more of a cushion.

Brad Shaw, chief executive officer of Shaw Communications Inc., issued a statement noting: “This new regulatory environment will not be without challenges,” but said the company supported it in principle.

Telus Corp., which does not own a content business, also welcomed the ruling and said it reflects a distribution model similar to what the company is using now.

Cogeco Cable Inc., which operates a large cable business in Ontario and Quebec but similar to Telus, does not have a television content division, also said it was pleased with the decision.

Mr. Yaghi noted that while the CRTC’s decision Thursday would have negative consequences for distribution companies, it will likely be worse for broadcasters, which can’t easily make up for the loss through increased charges in other areas.

Companies such as Corus Entertainment Inc. and DHX Media Ltd, which focus on creating content but have no distribution business, could come under pressure. Corus earlier argued that pick-and-pay would result in “a material reduction in Canadian programming choices,” including children’s programming and that some Canadians would be “paralyzed” by too many choices.

“[Distributors] will be able to replace that with an increase in Internet fees, but the guys who won’t be able to replace what they have right now … are the specialty channel operators. So, you will see the tension hit the broadcasting side of the business more,” Mr. Yaghi said.

Mr. MacDonald also predicted the move would “lead to the death of a number of channels.”

CHRISTINE DOBBY – TELECOM REPORTER

The Globe and Mail

Published Thursday, Mar. 19 2015, 7:32 PM EDT

Last updated Friday, Mar. 20 2015, 8:36 AM EDT