Brookfield Infrastructure Partners LP is acquiring Australian port and rail systems in one of the largest infrastructure deals this year, aiming to create a competitive international transport heavyweight.

The Hamilton, Bermuda-headquartered global infrastructure investor said Monday that it would take a majority stake in Melbourne-based Asciano Ltd. in a deal worth $8.6-billion, plus debt.

Brookfield Infrastructure, managed through Toronto-based Brookfield Asset Management Inc., envisages using its target’s assets to build two new global platforms.

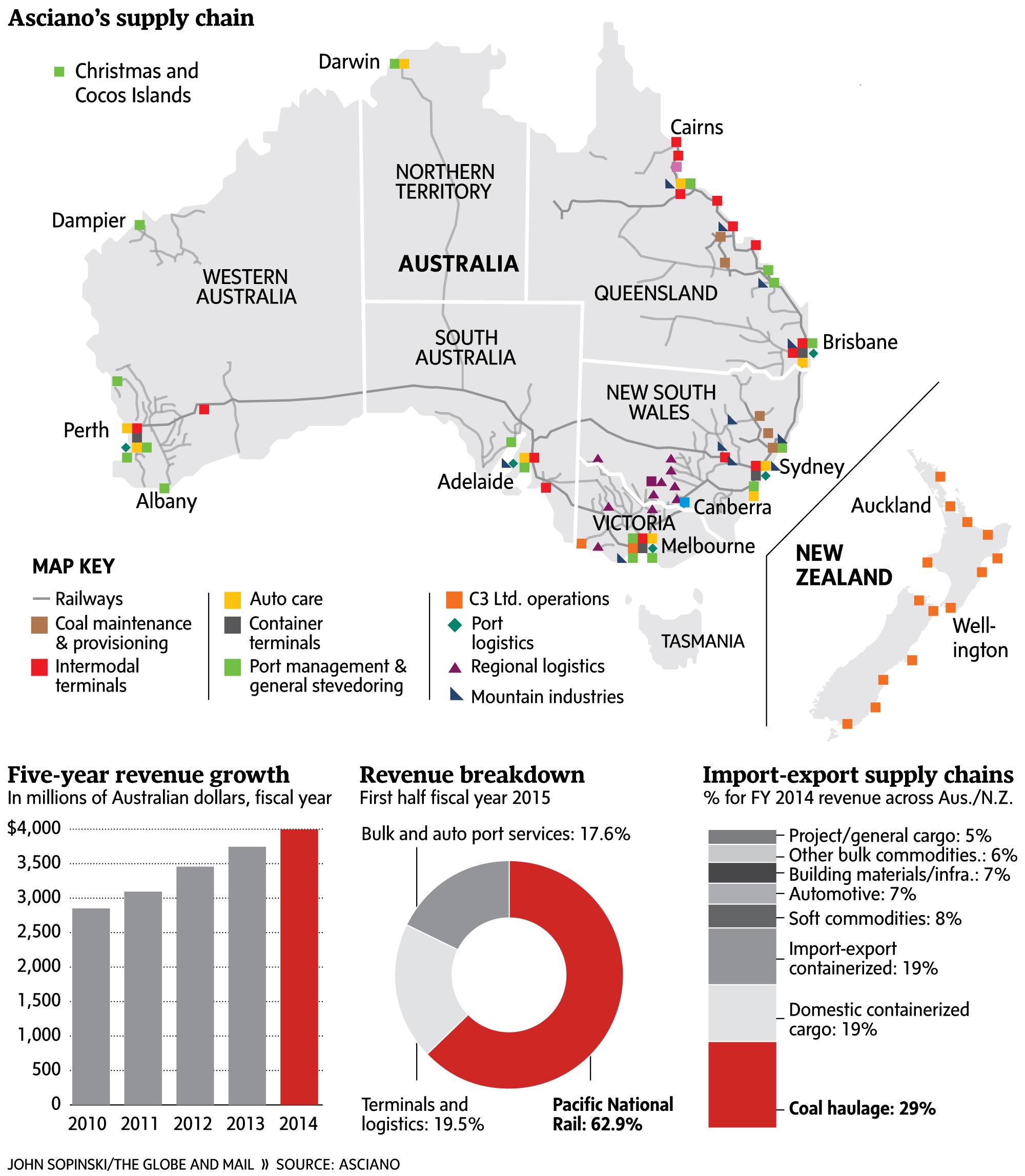

Asciano’s rail business, called Pacific National, has 664 locomotives hauling tonnes of coal, steel and other commodities. Brookfield Infrastructure would combine this with its existing Australian and Brazilian rail and logistics operations to form a bigger business.

Asciano’s port assets, called Patrick, are made up of a network of container terminals, port operations and supply chain support. “Combining Asciano’s Australian container terminals with our existing assets in North America and Europe provides the foundation for a global container platform,” Sam Pollock, chief executive officer of Brookfield Infrastructure, said in a statement.

Brookfield indicated that fusing these operations and expertise will build scale that can help diversify its customer base across new parts of the world, according to an overview of the deal released Monday.

Unlike some infrastructure assets, the profits of transport systems depend heavily on the strength of related economies, trade flows and ability to attract international clients. Global shipping practices have also been evolving in recent years, with many larger vessels that require deeper ports coming to market. That has spurred some port operators to upgrade their systems.

By the end of Asciano’s fiscal 2016 year, the company will have spent about $2-billion on new infrastructure with locomotives, cranes and improved automation within five years. And Brookfield has invested $1.2-billion developing its existing 5,500-kilometre rail freight network in the southern half of Western Australia in the past five years.

Brookfield’s investors have had time to digest the prospects of the acquisition since late June when its regulatory requirements prompted it to disclose its pursuit of Asciano.

Mr. Pollock said in a conference call at the time that he saw potential to “take advantage of a lot of knowledge about where those various challenges exist for customers – both from a capital perspective and just from an efficiency perspective” in the Australian market. He also said that the combined business lines would aim to generate value by developing new solutions for moving goods seamlessly by multiple transportation methods, such as by sea, land and rail.

Other institutional investors in Canada have expressed an interest in Australian infrastructure in recent years as state and federal governments in the region pursue privatizations of infrastructure. The country has launched an “asset recycling” program to sell government-owned ports, power lines and other assets to the private market. Pension funds such as the Caisse de dépôt et placement du Québec have acquired ports in the region, and others, such as the Ontario Municipal Employees Retirement System, have expressed heightened interested in Australian infrastructure.

Brookfield will have a 55-per-cent stake in Asciano. Another 23 per cent will be held by Brookfield-sponsored and managed funds, and two unnamed institutional partners holding will each have 11-per-cent stakes.

The deal is structured so that publicly traded Asciano’s shareholders will receive $6.94 Australian ($6.70 Canadian) in cash and 0.0387 Brookfield Infrastructure units for each share in the company. Brookfield plans to list its units on the Australian Securities Exchange, called the ASX, in addition to its Canadian and U.S. listings.

——————————–

Timeline of Brookfield Infrastructure’s venture into Australia

A few years ago, alternative asset manager Brookfield Asset Management Inc. spun off its infrastructure unit, which held some timber and electricity transmission assets in a few countries around the world.

Hamilton, Bermuda-headquartered Brookfield Infrastructure Partners LP didn’t start out with a presence in Australia, but it has swiftly established a footprint in the country at a time when many institutional investors are looking for opportunities in the region.

Here are a few key steps along Brookfield Infrastructures venture into the land down under:

Brookfield Infrastructure Partners formed, 2008

Brookfield Asset Management spins out a 60-per-cent stake in its infrastructure operations to create a new publicly traded business unit.

Deal for Babcock & Brown Infrastructure, 2009

Brookfield Infrastructure makes its first leap into Australia through an agreement to restructure the indebted Babcock & Brown Infrastructure of Sydney, in the wake the financial crisis. This gives Brookfield Infrastructure a 40-per-cent interest in the business for its $1.1-billion (U.S.) investment. Australian assets include a coal terminal in Queensland.

Deal for Prime Infrastructure, 2010

Babcock & Brown Infrastructure is renamed Prime Infrastructure and Brookfield loops back around to acquire the other 60 per cent of the business, valuing the company at $1.4-billion.

Prime’s key holdings include stakes in a rail company in Western Australia and port businesses in Europe and China.

Brookfield Infrastructure sells Powerco Ltd., 2013

Brookfield sells a 42-per-cent stake in New Zealand electricity and gas distribution company for about $410-million. The business was part of Babcock & Brown. Brookfield Infrastructure says it will “ harvest capital” from a mature business in pursuit of investments with higher returns.

Brookfield Infrastructure gathers equity, 2015

Chief executive officer Sam Pollock says he is watching Australia because of the $50-billion (U.S.) in state and federal government privatizations of infrastructure planned for the coming years.

Weeks later, Brookfield Infrastructure increases the size of an equity offering to pull in proceeds of $950-million due to strong investor demand. The company says the proceeds may fund acquisitions.

JACQUELINE NELSON

The Globe and Mail

Published Monday, Aug. 17, 2015 8:57AM EDT

Last updated Monday, Aug. 17, 2015 7:30PM EDT