A burger joint and a coffee shop are teaming up to take on the world of fast food, driven by a quest for foreign market share and hyper-competitive industry conditions.

The $12.5-billion tie-up of 50-year old Tim Hortons Inc. and Burger King Worldwide Inc. is all about conquering the U.S. market, and then the world.

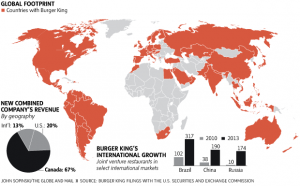

The companies said Tuesday that they will have $23-billion (U.S.) in combined system sales and more than 18,000 restaurants in 100 countries. Burger King and Tim Hortons will be owned by an unnamed Ontario-based parent company, while keeping their respective headquarters in Miami and Oakville, Ont.

This will make the new combined entity the third largest player in the so-called quick service restaurant space.

“We see no reason why we can’t bring the double-double to the rest of the world,” said Alex Behring, executive chairman of the new company and a co-founder of 3G Capital Inc., the Brazilian firm that will control the majority of the Tim Hortons-Burger King business.

The restaurants will have to find new places to expand.

Maturing fast food markets such as North America and Western Europe are approaching saturation, with franchises peppering the landscape, and quick service restaurants have experienced slowing revenue growth as a result, according to an industry report by research firm IBISWorld Inc.. As a result, many major fast food chains, such as McDonald’s Corp. and Yum Brands Inc. which owns Taco Bell, KFC and Pizza Hut, are clambering to make inroads in developing markets.

“Operators have made a major push into growth markets in emerging economies, including Asia, Russia, South America and India to expand their revenue and profit,” the IBISWorld report said. And while these growing markets make up a small slice of the $551-billion global fast food industry, the appetite for quick service in these countries has been growing much more quickly over the past five years, IBIS said.

Marc Caira, chief executive of Tim Hortons, has seen signs of this new era, which he characterized as one of “low growth, competitive intensity, value-conscious consumers and levering technology.” The coffee and donut chain set a five-year plan for building the company internationally earlier this year, but found it needed to move quickly.

“The real challenge was, was there a way for me to do what I needed to do, but do it faster? That’s where Burger King and 3G comes into play,” Mr. Caira told the Globe and Mail in an interview Tuesday. Mr. Caira said having one large shareholder will give Tim Hortons stability.

The terms of the deal will give Tim Hortons shareholders $65.50 (Canadian) in cash and 0.8025 common shares of the new company for each one of their shares. There will also be an option to receive an all-cash payment of $88.50 or 3.0879 shares in the new company instead. Burger King shareholders will have their stakes converted into 0.99 of one new company share, as well as 0.01 of a unit of a Ontario limited partnership that will be controlled by the parent company. 3G Capital will control 51 per cent of the new combined Tim Hortons and Burger King.

Mr. Caira will take on the role of vice-chairman and a director, focused on overall group strategy and global business development. Tim Hortons will also have three of the new company’s 11 directors. Burger King’s chief executive, Daniel Schwartz, will be CEO of the group in charge of daily mangement and operations.

Mr. Schwartz, who got his start as an analyst at 3G, said the private equity firm has long had an eye on Tim Hortons, considering its steady growth in same-store sales, a key measure in the retail industry. “On top of that, the ability to plug Tim Hortons into the global growth network we’ve established at Burger King, that’s kind of the icing on the cake,” he said in an interview Tuesday.

International growth has also become a major focus of Burger King, which now has almost 50 per cent of its franchised stores outside of the U.S.

The chain has made major changes since 3G bought the company for $4-billion (U.S.) in 2010, franchising out more of its restaurants to bring down overhead costs. One such change was adopting a “master franchise joint venture” model which involved sharing the rights to create Burger Kings with partners in different parts of the world. The joint venture partners control the supply chain, procurement and marketing for franchisees in their regions. Such deals have allowed Burger King to expand from 102 restaurants in Brazil in 2010 to 317 in 2013. In China and Russia, the growth rate of new restaurants has been even greater.

Along with expansion Mr. Schwartz and 3G also earned a reputation for intense cost-cutting, with head office staff layoffs and the sale of many company-owned restaurants to franchisees.

Mr. Schwartz said 3G with still be in a position of control, with many of its mangers haveing worked at the company, ownership of 51 per cent of the shares in the combined company and 8 seats on the board, with just three going to Tim Hortons. “We’re going to search the talent pool for the best people from both companies to run the combined company,” he said.

Mr. Caira shot down the suggestion that Burger King employees will one day be pouring Tim Horton’s coffee, but said the future could lead to more restaurants build near each other. “We’ve said that the two brands will be managed separately and independently, you could have a situation where you have in one corner a Tim Hortons, and around the corner, a Burger King,” he said in a conference call with analysts. We’ll have to wait and see.”

Conquering the fast food world is a race for distance runners, and 3G touted its long-term investments in companies such as Anheuser-Busch InBev, where some of 3G’s founder have been involved and invested since the early 1980s.

The involvement of famed value investor Warren Buffett and his firm Berkshire Hathaway Inc., which is contributing in $3-billion of preferred equity financing, also indicates a lengthy investment. Berkshire Hathaway knows 3G well from the joint deal the two did to acquire H. J. Heinz Co. for $28-billion (U.S.), which Mr. Buffett said he plans to own forever. Mr. Buffett told the Financial Times that he supported the structure of the deal to headquarter the new company in Canada, since the coffee chain pulls in more profits. “The main thing here is to make the Canadians happy, he said.”

The deal has already been “unanimously approved” by the boards of directors of both Burger King and Tim Hortons. The coffee chain’s shareholders will still need to vote to approve the transaction, but Burger King’s majority ownership will not require such a vote.

JACQUELINE NELSON

The Globe and Mail

Published Tuesday, Aug. 26 2014, 6:40 PM EDT

Last updated Wednesday, Aug. 27 2014, 3:25 PM EDT