The growth crisis deepens. The latest figures from Statistics Canada confirm that Canada suffered yet another decline in per capita GDP in the fourth quarter of 2023: the fifth decline in the past six quarters, the worst sustained drop in more than 30 years. Per capita GDP, after adjusting for inflation, is now below where it was in the fourth quarter of 2014, nine years ago.

Most news reports focused on the fact that the GDP itself (i.e. total output, not per capita) did not actually drop, but eked out a 0.2-per-cent gain, after the third quarter’s small decline – meaning Canada “dodged a recession.” But the problem with Canada’s economy is not cyclical, but secular; not one of utilization, but capacity. It is not so much that growth is temporarily below potential as that potential growth has slowed to a crawl.

Nor is this a short-run problem. It has been going on for decades. In the 1950s and 60s, Canada’s economy grew at a rate of more than 5 per cent annually, after inflation. By the 1970s that had slowed to roughly 4 per cent; to 3 per cent in the 1980s; to 2.4 per cent in the 1990s; to 2 per cent in the 2000s. Over the past 10 years, it has averaged just 1.7 per cent. Last year it was 1.1 per cent.

More to the point, the economy is now growing slower than the population, which is why per capita GDP is now falling. And it’s per capita GDP that really counts, as far as living standards are concerned.

At some point all this is going to shake Canadians’ sense of their place in the world. If you took a poll, I suspect you would find most Canadians still think of us as one of the richest countries on Earth: maybe fifth or sixth. And at one time we were. As late as 1981, Canada ranked sixth among OECD countries in GDP per capita, behind only Switzerland, Luxembourg, Norway, the United States and Denmark.

But we’re not any more. As of 2022 we were 15th. Over the 40-odd years in between, Canada’s per capita GDP grew more slowly than that of 22 other OECD members. Countries that used to be poorer than us – Ireland, the Netherlands, Austria, Sweden, Iceland, Australia, Germany, Belgium, Finland – are now richer than we are.

And over the next 40 years? You may recall that arresting chart in the 2022 budget, projecting Canada would have the slowest growth in per capita GDP among OECD countries out to 2060. We need to fully comprehend what this means. We are no longer one of the richest countries on Earth. Among the richer countries, we are on course to being one of the poorer.

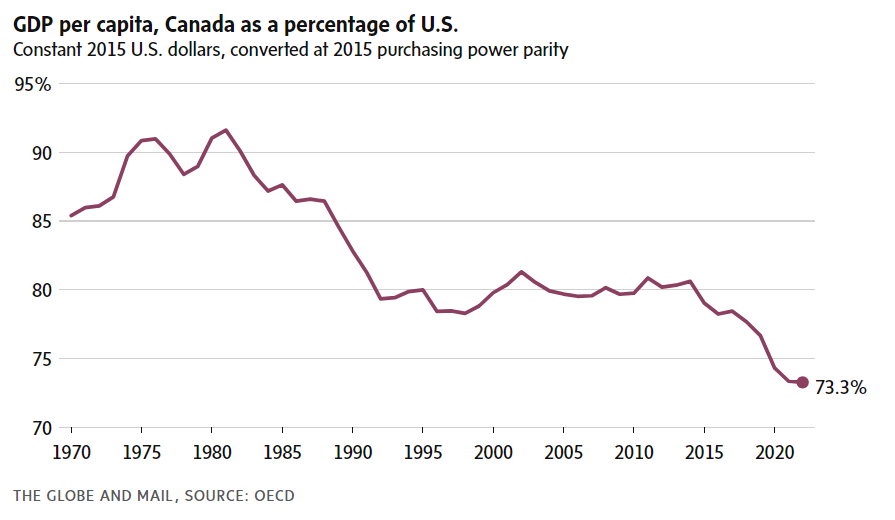

The picture is particularly distressing when you compare where we are with our nearest neighbour. As of 1981, per capita GDP in Canada was 92 per cent of that of the U.S.; by 2022 it had fallen to just 73 per cent. Drill down into the national data and it looks even worse. The economist Trevor Tombe has shown that Canada’s richest province, Alberta, would rank 14th among U.S. states. The poorest five provinces now rank among the six poorest jurisdictions in North America. Ontario ranks just ahead of Alabama. British Columbia is poorer than Kentucky.

Even this somewhat overstates our position. Canadians work more hours, on average, than people in other countries. Measured in output per hour worked – which is what we mean by labour productivity – we ranked 18th in 2022, having posted the slowest rate of productivity growth in the OECD since 1981, but for Switzerland. Given our performance in 2023, I don’t think we should be surprised to find we have since dropped out of the top 20.

Again, the contrast with the United States is striking: Up to about 2000, labour productivity in the two countries grew at roughly comparable rates. Since then, U.S. productivity has grown nearly three times as fast.

It is a dismal prospect. When an economy ceases to grow, it isn’t only living standards that suffer. It’s everything they represent. A society that cannot look forward to a future of rising living standards is one that is deprived of one of the primary motive forces of human behaviour – hope. Without the universal lubricant of growth, all of the divisions within a society – between the classes, between the generations, between sexes and races and (this is Canada, after all) regions – are likely to be more inflamed.

That might seem merely like a problem, something to be endured, or remedied, but not an immediate emergency. In fact it is a crisis – a slow-moving crisis, but a crisis nevertheless, thanks to the remorseless arithmetic of population aging.

As the postwar baby boom works its way through the country’s age distribution, and as everyone lives longer, the combined effect is to create a society unlike any that has ever existed. By 2040, roughly 25 per cent of the population will be over the age of 65, up from 19 per cent today. Compare that with the early 1970s, when the over-65s made up just 8 per cent of the population. And within that total the proportions over the age of 75, 85 and 95 and beyond will exceed previous records by even wider margins.

(As an example: In 1971, the proportion of the population over the age of 85 was roughly six-tenths of 1 per cent. Today it is more than three times as high, at 2.3 per cent. Twenty years from now it will have doubled again, to between 4.5 per cent and 5 per cent.)

This has two obvious implications. One is cost, particularly the cost of health care. As a rule of thumb, per capita consumption of health care doubles for each 10 years over the age of 55. Now add in the cost of pensions, elderly benefits, and so on. All told, the C.D. Howe Institute’s Parisa Mahboubi calculates, population aging represents a net unfunded liability (promises to pay future beneficiaries of government programs, beyond those for which revenues have been set aside) on the order of $3.9-trillion.

That’s on top of the unfunded liabilities in the Canada Pension Plan – another $1.2-trillion or so, plus whatever is lurking in the Quebec Pension Plan’s books. On top of the federal net debt of $1.2-trillion. On top of provincial debts totalling roughly $800-billion. Add it up, and that’s an implied public-sector obligation in excess of $7-trillion, or nearly 2½ times our annual GDP.

Now factor in the second implication: relatively fewer people of working age. Not too long ago, there were as many as five workers for every retiree. Before long, that ratio will have fallen closer to 2.5 to one. No doubt increasing numbers of people will elect to keep working past 65, but not enough to make much of a dent in the basic arithmetic of population aging: much higher costs, with fewer people to pay for them.

The only way out is faster growth. It doesn’t have to be a lot faster, so long as it is sustained: that way we get the magic of compounding working in our favour. If we can get our growth rate up, and keep it there, year after year, decade after decade, the next generation or two will be so much richer than we are that they can afford to look after us in our dotage.

This is why it is right to call this a growth crisis: at the very moment we most need growth to pick up, it has all but petered out. What makes this especially galling is that it is almost never talked about in our politics. Party leaders hammer away at each other over growth in the short term, though they can do very little to alter it. But long-term growth barely rates a mention.

Yet this is the sort of growth that governments can do something about. For all the fruitless debates about macroeconomic stabilization policy, and which form of stimulus, fiscal or monetary, is least ineffective at raising growth in the short term, the long-term growth trajectory of an economy really is responsive to policy.

To be sure, Canada’s failing productivity has many sources, and many remedies. I’ll just flag one or two for now. One is our anemic rate of investment, or as it is called in the statistical world, gross fixed capital formation. The alarming deterioration in our productivity performance closely tracks the extraordinary relative decline of business investment in Canada.

The OECD tracks investment across its 38 member states plus nine others. From 2011 to 2015, the growth rate of investment in Canada was merely awful: 37th out of the 47. From 2015 to 2023, it was appalling: 44th, ahead of only South Africa, Mexico and Japan.

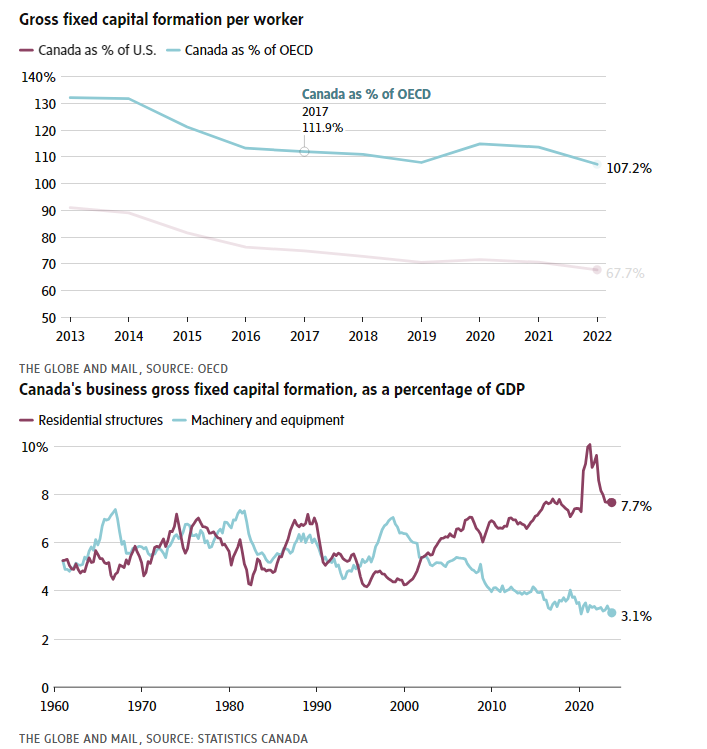

Simply put, our workers are less productive than other countries’ workers because they have less capital to work with. As recently as a decade ago, gross fixed capital formation per worker in Canada was within striking distance of the United States: about 95 per cent. It has since declined to roughly two-thirds. A similar decline has been observed relative to the OECD generally.

So getting our investment rates up is obviously one part of the solution. It matters, however, where the investment goes: what you invest in, as much as how much you invest. Disaggregate investment into its component parts, and you find a striking, and potentially troubling, trend.

Since around 2000, while business investment in residential structures has roughly doubled as a percentage of GDP, investment in machinery and equipment has roughly halved. Could this go some way to explain why our relative productivity growth fell off so sharply after then? Have we been so busy capitalizing on rising housing prices that we neglected to invest in the sorts of things that make it possible to afford a house?

ANDREW COYNE

The Globe and Mail, March 1, 2024