The federal government unveiled its 2023 budget on Tuesday with promised spending on the climate and dental care, and increasing taxes on higher-income Canadians. Here are the big takeaways from the budget.

Home savings account comes into effect

Following through on a pledge to create a tax-free home savings account, the government says financial institutions will be able to offer them as of April 1. The accounts will give first-time homebuyers the ability to save up to $40,000 and contributions will also be tax-free. Individuals can contribute up to $8,000 a year.

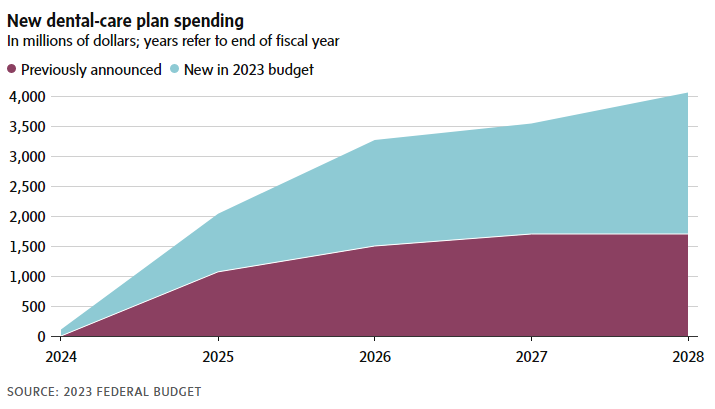

Dental plan

A national dental care plan for lower-income people will get started later this year. Uninsured Canadians with annual family income of less than $90,000 will be provided with dental coverage, and there will be no co-pays for families with incomes less than $70,000. The plan will now cost $13-billion over five years. Only about $6-billion had previously been budgeted. The government is also expanding coverage in remote communities and spending on getting more data on dental care from Statistics Canada.

Deficit projected to increase

Projections for economic growth have worsened since the government’s fall fiscal update and Ottawa has abandoned its fall projection to balance the books within five years. Instead, the fiscal year that begins April 1 is now projected to show a $40.1-billion deficit, compared with $30.6-billion in the fall update. By 2027-28, the government now forecasts the deficit will drop to $14-billion. That was the year the books had been projected to return to surplus according to the fall update.

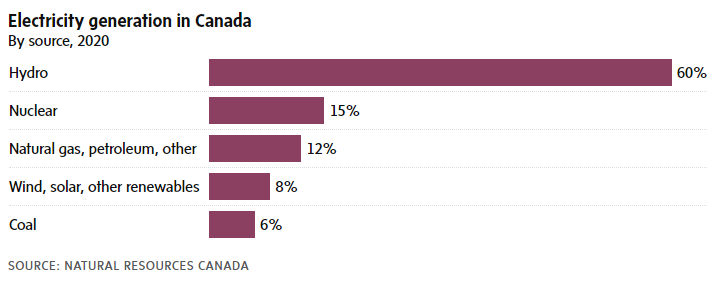

A big bet on electricity

The backbone of Ottawa’s green economy plan is a refundable tax credit worth $6.3-billion over four years for clean electricity that would be available to provincial utilities, as well as private and Indigenous-owned assets. Demand for electricity is expected to double by 2050 and the government views low-cost, clean electricity as Canada’s competitive advantage and key to its future economic success.

A growth fund for the clean economy

Previously announced in last year’s budget, the $15-billion Canada Growth Fund aims to capitalize on the trillions of dollars in private capital waiting to be spent on the clean economy by enabling an independent investment team through the Public Sector Pension Investment Board to make investments and manage assets.

Getting the rich to pay more

Ottawa is changing the alternative minimum tax (AMT) to make the wealthiest Canadians pay more by raising the rate to 20.5 per cent from 15 per cent, and limiting the excessive use of tax preferences. Under the proposal, the basic AMT exemption would increase to $173,000 from $40,000. The changes are expected to generate $3-billion in revenue over five years.

More aid for Ukraine

Canada is lending another $2.4-billion to Ukraine, bringing total support for Kyiv to more than $8-billion since the war began. The budget also provides nearly $172-million in additional support payments for Ukrainian citizens who are making Canada their home, at least temporarily. And Ottawa also announced nearly $85-million in additional humanitarian assistance for mental-health support, removing land mines, agriculture and other purposes.

Miscellaneous

- Limiting alcohol tax: The government is capping inflation-adjusted duties on alcoholic products at 2 per cent for one year only.

- Junk fees: Internet overage charges, concert, shipping and baggage fees are among those being targeted by the government through potential new legislation.

- Right to repair: In an effort to reduce expenses and waste, the government aims to introduce a right-to-repair framework in 2024, saying “Devices and appliances should be easy to repair, spare parts should be readily accessible, and companies should not be able to prevent repairs with complex programming or hard-to-obtain bespoke parts.”

- Common chargers: The government will work toward implementing a standard charging port similar to the European Union’s mandate of USB-C for all small handheld devices and laptops by 2025.

- Automatic tax filing: The Canada Revenue Agency will nearly triple the number of lower-income Canadians eligible for auto-file returns.

- Pregnancy loss leave: Federally regulated workers will have access to a leave to recover physically and emotionally from a pregnancy loss through planned amendments to the Labour Code.

IAIN BOEKHOFF

The Globe and Mail, March 28, 2023