My wife and I were at a Swiss Chalet not too long ago for dinner before a movie and they were too full to accommodate us. I am not kidding.

With close to all the tables seemingly occupied, a server apologetically explained that they would not be seating new customers at that time because they were short-staffed and very busy.

Food is where the inflation run-up of the past year has been felt most painfully, both in grocery stores and restaurants. But restaurant spending has until recently held up well enough for Swiss Chalet to be turning hungry customers away.

Recent numbers on restaurant spending have been up and down. But the results of a recent Carrick on money survey suggest cutbacks may be coming in spending at restaurants.

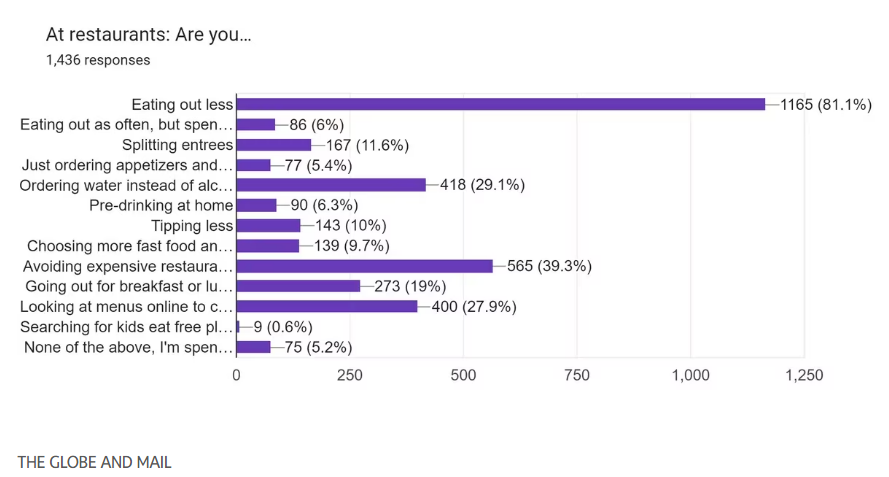

We asked people how they’ve changed their restaurant-going and grocery shopping habits in response to high food costs. You can see below that 80 per cent of the 1,485 people who responded said they’re eating out less. Other common tactics for managing costs suggest people who do go out to eat will spend less on booze, and avoid expensive restaurants. One in 10 said they would tip less.

Restaurants were among the hardest hit sectors in the pandemic lockdowns. Since reopening, they’ve had to deal with food inflation and a tight labour market that has required them in some cases to raise wages to attract staff. Prices had to go up, and customers paid up as they celebrated the wind-down of pandemic restrictions.

But prices today are jarringly expensive in many cases. I’ve picked up more than a few menus in recent months and marvelled at the cost of even routine items like burgers. Pricey entrees that used to be in the low $30 range have pushed into the $40 neighbourhood and beyond in some cases.

There’s a lot of speculation these days about whether the economy will fall into recession. Restaurant spending could be a leading indicator of a downturn.

By the way, the Swiss Chalet saga has a happy ending. We drove to another location, got served quickly and made our movie on time. The fries were excellent, as expected.

ROB CARRICK

PERSONAL FINANCE COLUMNIST

The Globe and Mail, February 16, 2023