inance Minister Chrystia Freeland delivered a fiscal update Monday that promises a stimulus plan of up to $100-billion will launch once the COVID-19 crisis eases, but the government won’t release the details of that plan until the 2021 budget.

Monday’s update pushes the projected size of this year’s deficit to $381.6-billion, up from the $343.2-billion forecast in early July. The report notes that the deficit could be just shy of $400-billion if the pandemic worsens, leading to more restrictions.

The promised stimulus spending will be in addition to the hundreds of billions of dollars Ottawa has already spent to support workers and businesses through the COVID-19 crisis.

“I want Canadians to know we have a plan to get through the winter. We have a plan to provide vaccines to Canadians and we have a plan to build our economy back in the spring,” Ms. Freeland told reporters at a news conference in Ottawa. She said that $8 out of every $10 spent on fighting the pandemic in Canada has come from Ottawa.

While some business groups welcomed the emergency spending, they noted a lack of plan for the economic recovery. And the Canadian Medical Association said the federal government’s update overlooks the crisis in health care.

Monday’s update is the government’s first attempt at putting a price on the wide-ranging spending plan it outlined in September’s Throne Speech, which promised a recovery plan focused on fighting climate change and reducing inequality.

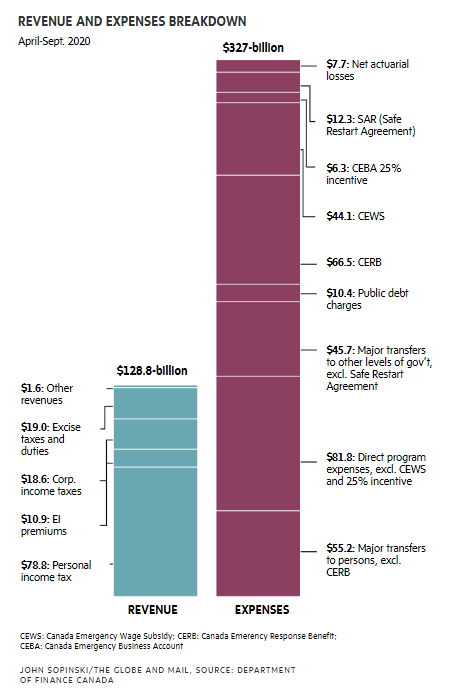

The update also provides the latest projections for the billions in emergency spending programs that have been announced throughout the year to support individuals and businesses during the pandemic.

The government said the stimulus of between $70-billion and $100-billion will be budgeted over the three fiscal years that start April 1, 2021. Before accounting for that stimulus, the update projects a deficit of $121.2-billion in 2021-22 and $50.7-billion the following year.

As a percentage of GDP, the federal debt, before including stimulus, will climb from 31.2 per cent last year to 50.7 per cent this year and 52.6 per cent next year. It is then forecast to fall slightly.

Including stimulus measures and a worsening pandemic, the update shows the federal debt-to-GDP ratio could reach 58.5 per cent. By way of comparison, the debt-to-GDP ratio reached 66.8 per cent in the mid-1990s, when the concern of bond-rating agencies forced Ottawa to approve deep spending cuts to bring the deficit under control.

In the House of Commons, the Liberals were accused by the Conservatives of “running towards” a repeat of the 1990s debt crisis.

Conservative Leader Erin O’Toole charged that the government has failed Canadians by not detailing a vaccine plan in the economic update. While criticizing the lack of a full budget since the onset of the pandemic, Mr. O’Toole said Monday’s document was a “stealth budget” full of red ink that has turned “crimson” but features “no plan.”

NDP Leader Jagmeet Singh said the government should have moved more aggressively to raise tax revenue from multinational corporations and the “ultrarich” to pay for its spending promises.

Bloc Québécois Leader Yves-François Blanchet said the lack of detail on stimulus suggests the Liberals are setting the stage for a 2021 budget that will double as an election platform.

“Clearly, the Prime Minister is opening a window for a spring election,” he said.

Several business groups said the government should be clearer as to how it intends to spend up to $100-billion on economic stimulus.

The Business Council of Canada said the update “lacks a substantive plan” to spur private sector investment and recovery.

“Business, not government, is the primary engine of job creation and sustainable economic growth,” said Goldy Hyder, the council’s president and CEO, in a statement.

His comments were echoed by Canadian Chamber of Commerce’s president and CEO, Perrin Beatty, who welcomed the emergency spending but said “the government’s plans to manage the pandemic and restore economic growth remain unclear.”

Critics of the government’s deficit spending have urged Ms. Freeland to announce a fiscal anchor, which would include a plan for reducing the debt and deficit. She said that will come later.

“When the economy has recovered, the time-limited stimulus will be withdrawn and Canada will resume a prudent and responsible fiscal path, based on a long-term fiscal anchor we will outline when the economy is more stable,” she said in an opening note to the update. Until then, the government will rely on “fiscal guardrails” such as the employment rate and total hours worked.

When pressed by reporters, Ms. Freeland acknowledged that the specific details for her planned guardrails aren’t yet available, but said more details will be released with the stimulus plan.

Monday’s update included several significant policy announcements.

The government is moving ahead on a promise to require international digital companies such as Netflix to collect and remit federal sales tax on digital sales. The government is also planning restrictions to the stock option deduction.

A plan to offset the cost of energy retrofits for homeowners will receive $2.6-billion over seven years, and an existing program to build electric vehicle charging stations will receive an additional $150-million.

The government is also increasing the maximum Canada Emergency Wage Subsidy rate from 65 per cent to 75 per cent, starting Dec. 20 and continuing until March 13, 2021.

The current subsidy rates under the Canada Emergency Rent Subsidy and the Lockdown Support program, which provides a 25-per-cent top-up, will be extended until March 13, 2021.

For Canada’s hardest-hit businesses, in tourism, hospitality, arts and entertainment, the government said it will create a Highly Affected Sectors Credit Availability Program. This will offer 100 per cent, government-backed loans at below-market interest rates. The update said more details on that program will be announced soon.

For the live-events and arts sector, the update said the government will spend $181.5-million in 2021-22 to “provide work opportunities in these sectors.”

While the government continues to negotiate an aid package for Canada’s major airlines, the update announced support for large and small Canadian airports. An Airports Capital Assistance Program will receive $186-million over two years, and a new direct transfer program to large airports will be worth $500-million over six years. This can be used for transit projects such as the planned light-rail link to Montreal airport.

The government said Monday that it is “exploring options to enhance” the Large Employer Emergency Financing Facility. The Globe and Mail recently reported that the federal government has spent almost $5-million on outside consultants to help manage the program, yet it has only delivered two loans since launching six months ago.

On child care, the government will spend $20-million over five years on a new Federal Secretariat on Early Learning and Child Care for policy analysis and $70-million over five years for Indigenous participation in developing a Canada-wide child-care system. The government said it would provide a plan for “affordable, accessible, inclusive and high-quality” child care in the 2021 budget.

The total estimated price tag of all policy measures related to COVID-19, including spending and loans, is now $490.7-billion, up from an estimated $403.3-billion in the July fiscal snapshot.

Missing from Ms. Freeland’s speech was any mention of the Liberal promise to establish a national pharmacare program. The economic statement did not announce new spending for the initiative.

Ahead of the economic update, the provinces and territories called for permanent increases to the Canada Health Transfer. The Prime Minister will discuss the matter with premiers at a Dec. 10 meeting, but no new funding was announced in Monday’s update.

The CMA, which was also highly critical of the Liberal government’s Throne Speech, also said the economic update “fell short.” The health care system is sending out an “SOS,” said president Ann Collins in a statement. The spending plan “should have offered health care providers hope of relief and a glimpse of the federal leadership required to keep our health system afloat,” Dr. Collins said.

The government did signal support, however, for another provincial request, which is to reform the Fiscal Stabilization Program. The transfer kicks in when a province experiences a sudden drop in revenue due to economic factors. The government said Monday that this change will lead to “billions” in additional provincial support next year.

BILL CURRY AND MARIEKE WALSH

The Globe and Mail, November 30, 2020