Russia has struck a deal to supply some $400-billion (U.S.) worth of natural gas to China over three decades, a breakthrough pact that solidifies ties between the nations as the West seeks to isolate Russia amid the crisis in Ukraine.

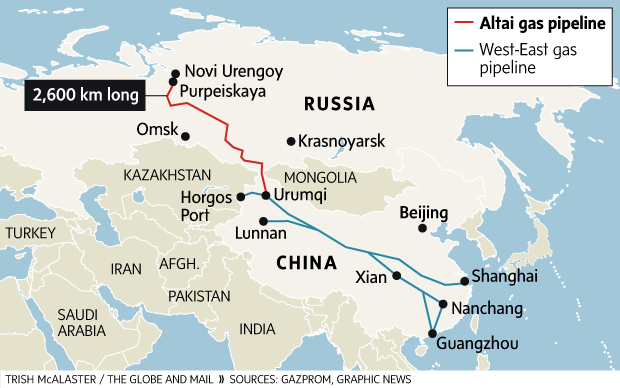

After a decade of failed attempts, the countries struck the agreement on Wednesday while Vladimir Putin and Xi Jinping, the presidents of Russia and China, were in Shanghai for a two-day conference. The deal will spark development of massive gas fields in Eastern Siberia and the construction of some 4,000 kilometres of pipelines, efforts that together are expected to cost $55-billion (US).

Under the deal, China agrees with a single stroke to buy from Russia’s OAO Gazprom nearly half the volume of natural gas consumed by all of Canada.

And for Canada, that new source of natural gas is another sign that its own ambition to become a major exporter of the commodity faces intensifying global competition. Energy companies are planning several liquefied natural gas export projects on the British Columbia coast, but Canada is well behind other international players.

B.C. Premier Christy Clark insisted the province is still well-positioned to become an LNG exporter. She said Asian buyers, including China, still want their suppliers to include countries that offer reliability over the long term.

“We’ve certainly seen the way that Russia likes to do business these days, and we certainly know that the Chinese want a dependability of supply. We can supply that,” Ms. Clark said at a Vancouver news conference on Wednesday. “Being honourable, being trustworthy, providing the assurance that we are not going to play politics with energy. I think that’s worth a lot to our potential customers out there, especially for China.”

Shamsul Azhar Abbas, the chief executive officer of Malaysia’s state-owned Petronas, also played down the impact of the Russia-China natural gas deal on Canada’s fledgling LNG industry, and specifically the Petronas-led Pacific NorthWest project.

“What I am interested in is whether it will compete directly with our Canadian project, and the answer is no. The beautiful part of our project is that we have a buyers’ consortium,” Mr. Shamsul said during an interview at an international LNG conference in Vancouver.

The Pacific NorthWest LNG joint venture is being planned for Lelu Island, near Prince Rupert in northwestern British Columbia. “As far as China is concerned, they have a very huge need for energy,” Mr. Shamsul said.

Russia’s pact with China is “the biggest contract in the entire history” of the country and OAO Gazprom, the world’s largest gas producer, chairman Alexey Miller said. The deal involves 3.7 billion cubic feet of gas per day. On Wednesday evening, Mr. Xi and Mr. Putin looked on and applauded as the sales contract was signed by Gazprom and China National Petroleum Corp. The leaders’ presence underscored the significance of an agreement that will create a ribbon of steel linking the two countries even as Western nations seek to diminish their economic dependence on Moscow because of the conflict in Ukraine.

Mr. Putin called the deal an “epochal event” for Russia. His country’s energy sector represents nearly a third of its GDP, and about half of federal government revenues.

Its importance goes well beyond its financial impact.

The deal is a message from Mr. Putin to Europe to “do your worst. We are not reliant on your friendship. If you want to apply sanctions and behave unreasonably to us, we will turn to our good buddy the Chinese,” said Bobo Lo, a British academic who has spent decades studying Russia’s foreign policies and geopolitics.

Or, as Russian parliamentarian Alexei Pushkov put it in a tweet, U.S. President Barack “Obama should abandon the policy of isolating Russia: it will not work.”

Russia and China expect the first gas to flow in four to six years. Although financial terms were not disclosed, China is expected to pay about $20-billion up front toward the enormous cost of building pipelines that will deliver gas to Beijing, and further south to the Yangtze River area.

Gazprom expects to sell the gas for about $350 per thousand tons, or $9.91 per thousand cubic feet. While that is far above prices in North America, where gas has lately traded for around $4.50, it’s well below the pricing for Pacific liquefied natural gas.

Russia nonetheless celebrated the deal, which ties the price of gas to the price of oil, prompting a headline in one Russian media outlet: “Putin dictates price to China.”

The deal is unlikely to allow Mr. Putin to do the same to Europe. Gas destined for China will come from a region of Eastern Siberia that is a great distance from the drilling rigs that feed Europe, meaning it would not be possible to divert gas from Munich or Kiev to Beijing. It is new energy for new customers, as China burns more gas to reduce its dependence on coal.

The more important question for global energy markets involves the deal’s influence on the way gas is moved on ships. For Australia, Mozambique, the United States and Canada, China has held promise as a lucrative new market for sea-borne liquefied natural gas. The pipeline from Russia is the “least-cost trade pathway,” meaning it is cheaper than any other potential source of imports for China, said Kenneth B. Medlock III, senior director at the Center for Energy Studies at Rice University in Houston, which has developed a global model of the natural gas trade.

(That gas will be worth $10.50 to $11 by the time it reaches Shanghai, Mr. Medlock said, which slightly reduces its pricing advantage.)

Meanwhile, Russia is looking to quickly seize LNG market share as well. The development of the Eastern Siberian gas fields will allow Russia to tap additional supplies that can be exported onto tankers through the Pacific port at Vladivostok. And China, in a separate deal, agreed to buy a smaller volume of LNG from the Yamal project, which will help support construction of that undertaking in Russia’s Arctic.

The combined effect stands to disrupt LNG markets as Russia elbows in with large new supplies. That places new pressure on countries like Canada, whose bid to be early to market has been eclipsed by Russia.

The earliest discussions of LNG shipments from Canada’s West Coast pointed to a potential bonanza, with Asian prices far higher than those in North America. And although rising natural gas demand means the Asian market remains for the taking, the Russian deal underlines the need for Canada to think differently about exporting to the Pacific, said Peter Tertzakian, chief energy economist at ARC Financial Corp. in Calgary.

“The trick for Canada is to make sure we get to market with a good, low-cost product,” he said. “Because there’s no point in getting to market only to find out you’re the high-cost producer.”

NATHAN VANDERKLIPPE AND BRENT JANG

BEIJING and VANCOUVER — The Globe and Mail

Published Wednesday, May. 21 2014, 3:36 PM EDT

Last updated Thursday, May. 22 2014, 6:45 AM EDT