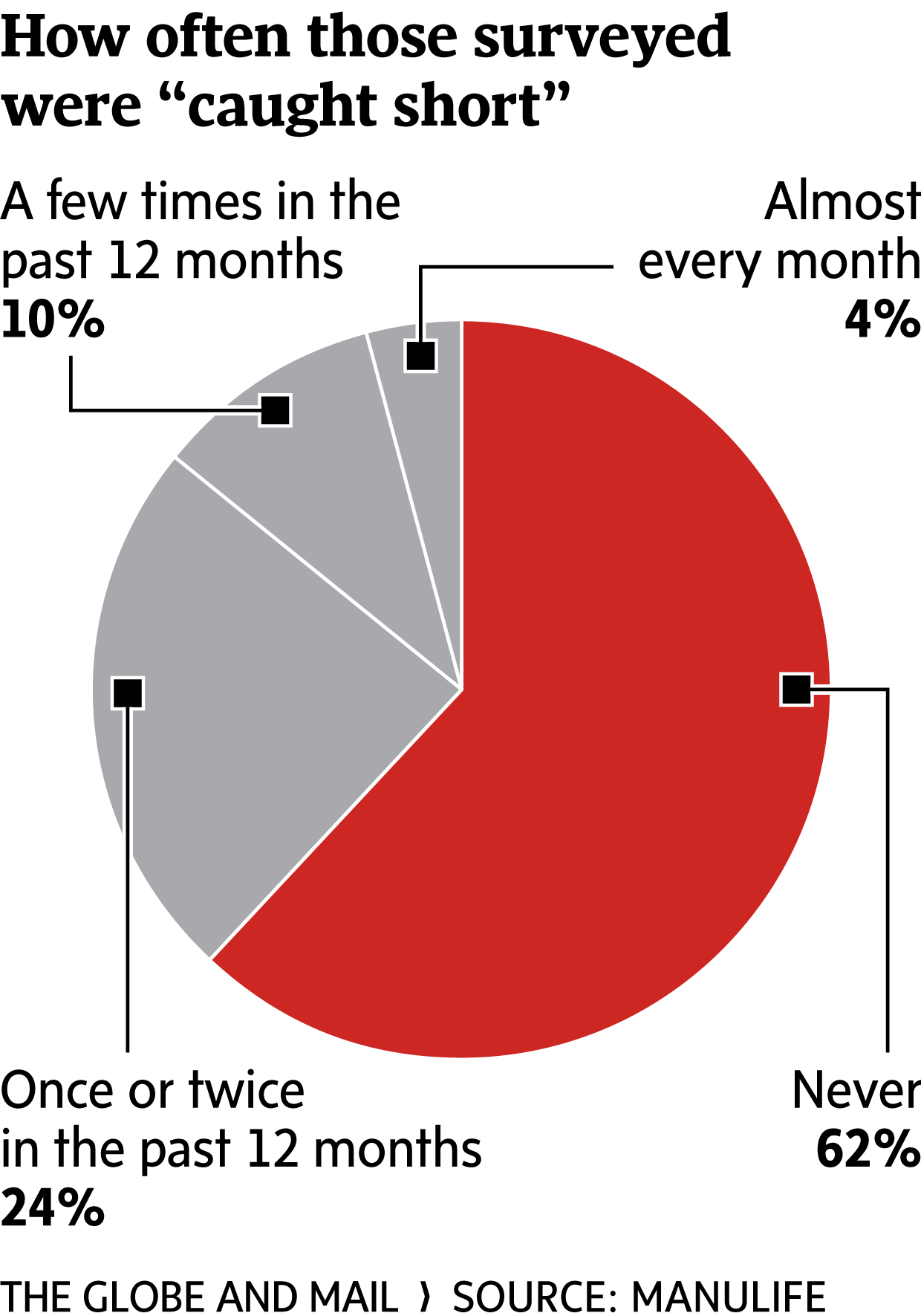

Nearly 40 per cent of Canadian homeowners say they have found themselves short of money to cover their monthly expenses at least once in the past year, turning to debt, cashing in savings or borrowing from family to pay the bills.

Rising house prices have contributed to the sizable share of homeowners who struggled to pay their bills, with 38 per cent who have a mortgage telling a survey by Manulife Bank of Canada that they considered their local housing market to be unaffordable.

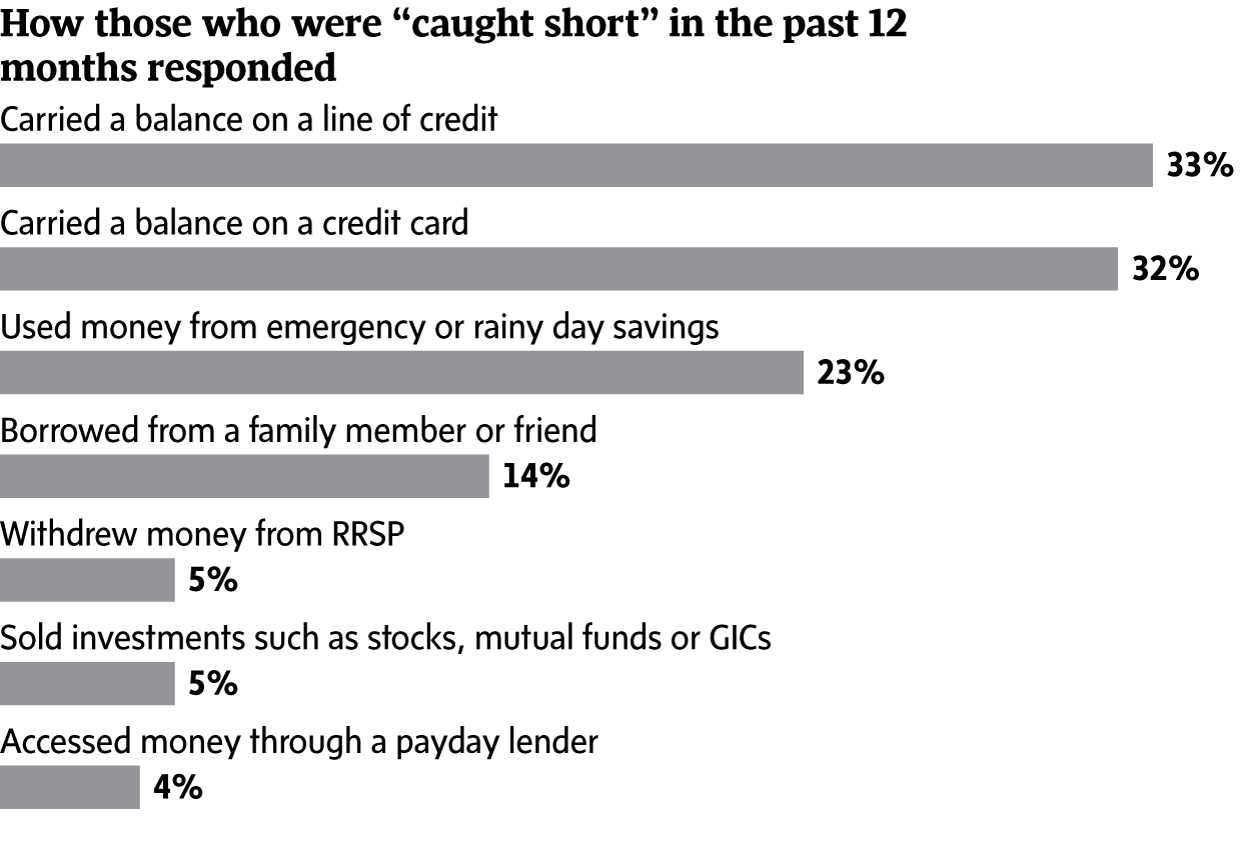

Of those who said they had been caught short on cash to pay their monthly expenses, roughly a third turned to credit cards. Similar numbers dug into a line of credit, 15 per cent borrowed money from family and 10 per cent cashed in RRSPs or sold investments. Less than a quarter used a dedicated emergency fund, while 4 per cent used payday loans.

“It’s probably a factor of the housing market itself today,” said Manulife Bank chief executive officer Rick Lunny. “A lot of Canadians are all-in on housing these days and as a result there isn’t a lot of flexibility in their day-to-day financial situations.”

Despite sometimes scrambling to pay bills, roughly three-quarters of homeowners said they considered themselves to be well prepared for an unexpected expense, such as a major car or home repair. But that, too, is at odds with their experience. About half of those surveyed said they had less than $1,000 saved away for emergency expenses and many of those didn’t know how much they had saved.

Rising home values helps explain the gulf between Canadians’ confidence in their ability to weather a major expense and their financial reality. The housing market has been a major driver of economic growth in Canada over the past decade, with much of that coming from the “housing wealth effect” – the boost to consumer confidence provided by rising home values, a report from Toronto-Dominion Bank found.

TD economist Brian DePratto estimates that for every dollar of increased housing wealth, Canadian consumers have boosted their spending by an extra 5 cents, with rising home prices contributing to 21 per cent of the growth in consumer spending since 2001.

National home prices could fall 1 to 3 per cent over the next 2 1/2 years, the bank predicts, with the resource-sensitive regions of Alberta, Saskatchewan and Newfoundland seeing the steepest declines. But even a modest downturn could have significant effects, slowing the gross domestic product growth rate by 0.5 percentage points at a time when Canada is leaning heavily on consumers to pull itself out of an oil-related slump.

“Consumer spending will lose an important tailwind, even in the absence of a material decline in prices,” Mr. DePratto wrote.

Not everyone agrees with that assessment. Two-thirds of homeowners told Manulife they expected home prices to continue to rise next year. That figure was as high as 80 per cent in Toronto and Vancouver. By contrast, nearly 20 per cent of homeowners in Calgary and Edmonton expected prices in their cities to fall next year. The average homeowner in the study owed $175,000 in mortgage debt.

The survey, conducted by Environics Research between July 22 and Aug. 7, is based on responses from 2,372 Canadian homeowners aged 20 to 59 with household incomes of at least $50,000. National results are weighted by age, gender and region.

TAMSIN MCMAHON – REAL ESTATE REPORTER

The Globe and Mail

Published Thursday, Nov. 26, 2015 12:01AM EST

Last updated Thursday, Nov. 26, 2015 9:13AM EST