Household finances are showing more signs of cracking under the weight of large debt loads and high interest rates – except when it comes to the most critical loans of all: mortgages.

In the first quarter, Canadian household debt levels inched up to a record high, with the typical household owing almost $1.85 in credit market debt for every dollar of disposable income, according to Statistics Canada. At the same time, soaring interest rates mean debt payments are taking a big bite out of incomes – and that was before the Bank of Canada’s latest rate hike on June 7.

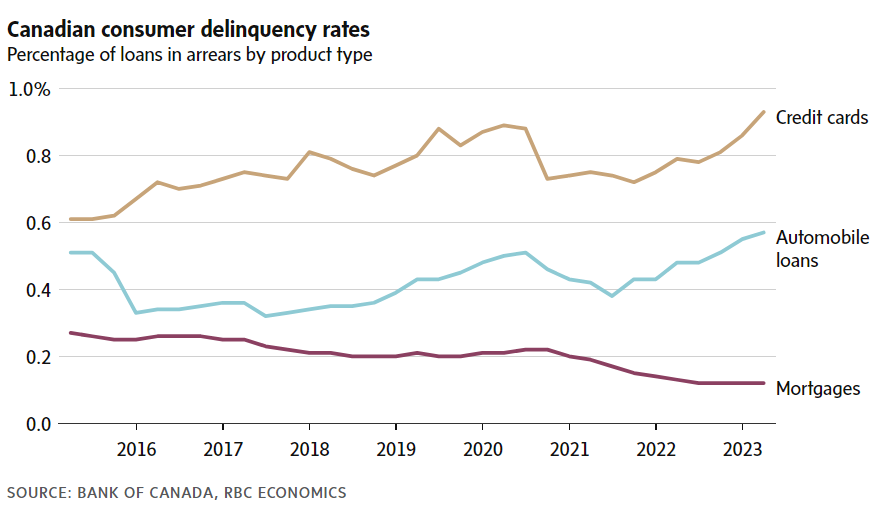

The strain is obvious in credit cards and vehicle loans. New figures from the central bank this week show delinquency rates for both products are now higher than they were before the pandemic. While they are still relatively low – less than 1 per cent – the trajectory has economists worried.

That’s because mortgage arrears are a lagging indicator, meaning they typically follow the path of other types of debt. That just hasn’t happened yet.

Mortgage delinquencies remain at record lows thanks to the extraordinary steps lenders have taken to shield borrowers from the pain of higher rates, such as allowing homeowners to add unpaid interest to a loan’s principal or stop paying down the principal altogether. But both measures extend the amortization period of a mortgage, creating risks down the road.

The kick-the-can approach is coming under increased pressure. This week, Canada’s banking regulator called on financial institutions to tackle mortgage extensions “before levels of borrower stress become unmanageable.”

ROB CARRICK

PERSONAL FINANCE COLUMNIST

The Globe and Mail, June 15, 2023