Falling house prices have failed to make home ownership more affordable. Young adults are not taking it well.

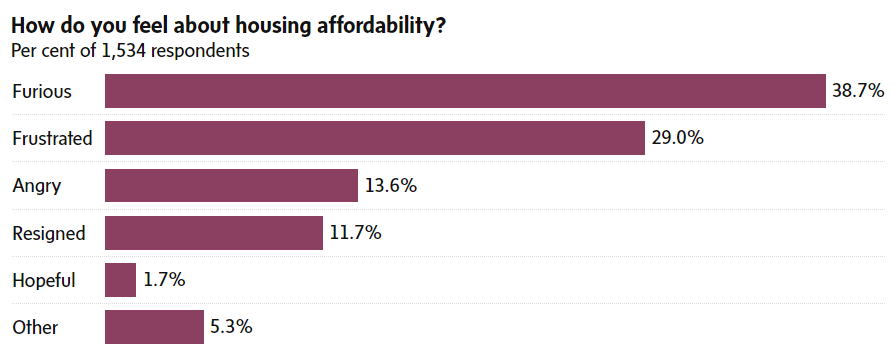

To gauge the mood of Gen Z and millennials on home ownership, I ran a survey in the Carrick on Money newsletter last month. Of the 1,545 people between the ages of 20 and 40 who replied, 52 per cent described themselves as either furious or angry about housing affordability.

We built home ownership into the pinnacle experience of Canadian adulthood. How will we deal with all the young adults who want to get in the door but can’t?

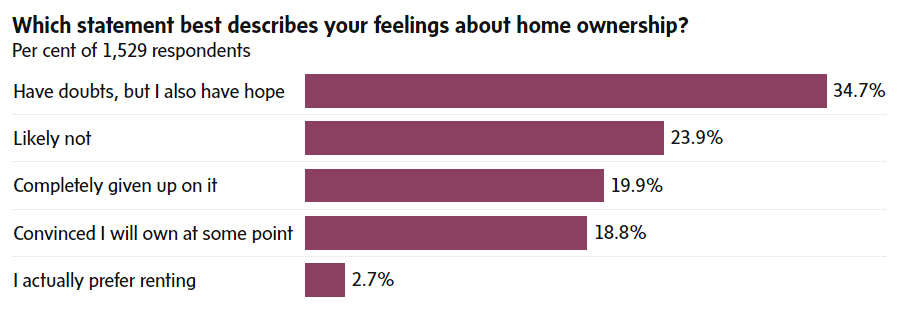

Almost 44 per cent of survey participants have completely given up on home ownership or feel it likely won’t happen. Just 19 per cent said they’re convinced they’ll own a home at some point.

What do you tell a 20-something who is doubtful about ever owning a home? Hang in there, kid. You have time to build your career, get a promotion or two and increase your income. Home ownership may come later, when you’ve built your earning and saving power.

But 63 per cent of survey participants were in their 30s. Their pessimism is influenced by years of working, saving and watching house prices soar for the most part.

Parental financial help has in the past been a big factor in getting young people into a first home. A CIBC Economics report from 2021 showed that parents had given their adult kids just over $10-billion in down payment help in the past year, and that almost 30 per cent of first-time buyers got this help.

But the Carrick on Money survey reinforces how parental help is relevant only to a fortunate few. Just over 51 per cent of participants said they are not counting on financial help from parents or family to get into the housing market, and 20 per cent said the matter hasn’t been discussed.

A complication in the story of housing market affordability is expensive rent. Just over 60 per cent of survey participants rented solo or with roommates, with the rest living at home with parents or in other arrangements. In the rental group, just 37 per cent said they had enough money left over after rent and expenses to save regularly for a down payment. Twenty-seven per cent were able to save now and then, and 36 per cent said there was no money left after rent to save for a home.

There are answers to expensive houses, and participants in the Carrick on Money survey were receptive. Just over 85 per cent of survey participants said they were open to buying a home in their late 30s or 40s, and two-thirds said yes or maybe to moving to another city or province.

But the overall feeling of the survey results is that young adults are struggling to process what’s happened in the housing market and feeling angry about it. Just 1.7 per cent described themselves as hopeful about owning, while 29 per cent were frustrated and 12 per cent were resigned.

Close to 39 per cent said they were furious, making this the most popular response to a question about how participants felt about housing affordability.

The role of renting in this anger has to be considered if we accept that home prices are never going to fall enough to make a big difference in affordability. The average rent in March for a one-bedroom unit hit $1,752 on a national basis in March on Rentals.ca, with Toronto at $2,501 and Vancouver at $2,640.

Renting has long – and unfairly – been trashed as pure foolishness, i.e. throwing your money away, paying your landlord’s mortgage and passing up guaranteed rising home equity. No wonder just 2.7 per cent of survey participants answered a question on how they feel about home ownership by saying they actually prefer renting.

We actually have two housing problems to fix in this country – unaffordable home ownership and expensive rent. No wonder so many young people are furious about what’s happening in the housing market.

ROB CARRICK

PERSONAL FINANCE COLUMNIST

The Globe and Mail, May 3, 2023